The IRS Has Ruled. What Are You Waiting For?

On November 22nd, 2019 final regulations were released by the IRS (Internal Revenue Service) which put to bed the concerns about clawbacks of any grantor gifts made due to the sunset of the current lifetime exemption limits expanded by the 2017 Tax Cut and Jobs Act of the Trump Administration. A WealthManagement.com article published on November 26th goes into great detail on the regulations.

So, with this concern out of the way for good, what is the plan now? Why wait to take advantage of this massive gift to move assets generationally and forever escape the gift and estate tax system, which is constantly changing? We may never again see gift tax exemption levels like the ones that were enacted in 2017.

I have written a lot on this subject. To refresh quickly, the 2017 Tax Cut and Jobs Act increased the lifetime gift and the estate exemption limit to $10,000,000 per individual or $20,000,000 per married couple adjusted for inflation through indexing. This essentially doubled the previous limits. Today, at the end of 2019, the limits have been indexed to $11,400,000 per individual and $22,800,000 per married couple. The 2020 limits have been announced and will be increasing to $11,580,000 per individual and $23,160,000 per married couple.

The Trump Tax Act, as it is known, also created a sunset date of the limits on January 1st, 2026 to return to the previous limits, also indexed for inflation. Regardless of what may happen politically, we know that this limit will change unless it is permanentized, which is very unlikely in our current environment. Furthermore, there are already proposals to reduce the exemption to $3,500,000 per individual or $7,000,000 per married couple. Just thinking about how to explain this makes my head hurt. The estate and gift tax regime has been hotly debated for years and this debate will likely continue as political parties change control OR our national debt becomes so onerous that we will all be taxed to death regardless of net worth … no pun intended.

For taxpayers who are fortunate enough to have a meaningful net worth and are desirous of leaving legacy assets to their children, grandchildren, great grandchildren or others along the way, making a gift today is an important tax strategy to consider.

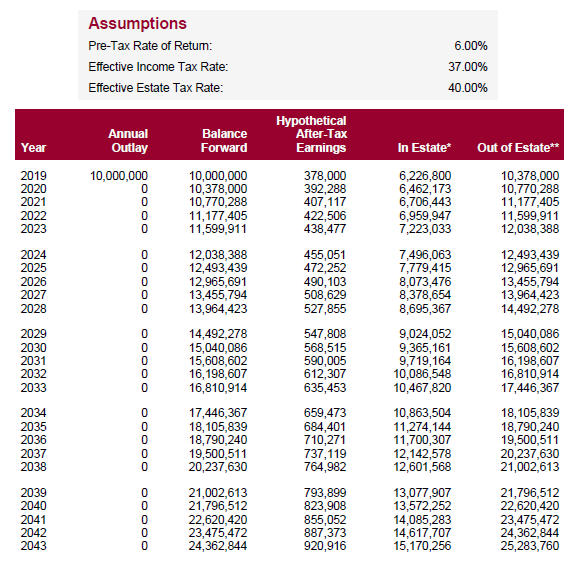

Let’s explore the benefits of making a $10,000,000 gift to a trust, as an example, and getting that asset plus all its appreciation FOREVER out of the taxpayer’s taxable estate. Assume that the taxpayers are a 65-year-old married couple with meaningful income and assets. The chart below shows a 25-year comparison between leaving the asset in the estate versus making the gift in 2019. At the end of 25 years, over $10,000,000 would be lost to taxes to the detriment of the legacy of the taxpayer. I don’t know about you, but I DO NOT know many wealthy people who would be happy with this result.

* In Estate: The value of an asset reduced by the assumed effective estate tax should death occur.

** Out of Estate: The value of an asset held outside of the estate in a trust or similar strategy which would not be subject to the assumed estate tax should death occur.

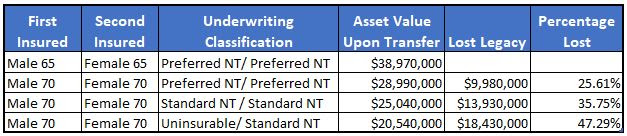

Many planners use the gifted assets to leverage them up by purchasing second-to-die life insurance. Without getting into a long discussion about product (because it really doesn’t matter), we ran one of the more competitive guaranteed for life products available in the market. For a 65-year-old couple (male and female) in good health, the amount of insurance protection, or said a different way, the value of the assets left in the trust assuming the second-to-die is age 90 is equal to $38,974,000. This is a return of 5.59% tax free (8.87% pre-tax assuming a 37% tax rate) – GUARANTEED and completely uncorrelated to any other asset or investment on the planet!

But wait, as they say, there’s more. This value is paid to the trust regardless of what equities, debt or other markets are doing in that particular year OR what they have done in past years. Insurance is ALWAYS available at face value. For those of you who remember 2008-2009, imagine having a $10,000,000 asset at the beginning of 2008 and think about what it would have been worth by the beginning of 2009… $6,000,000? $6,500,000? My point is that clients cannot predict what the markets will be doing on the day they pass away, so locking in an asset that is guaranteed to be worth exactly what they know it to be is POWERFUL.

So back to the IRS clawback announcement. Why would anyone wait? The reality is that most wealthy people are generally at an age where their health can be fragile. Furthermore, as each year passes, insurance is just a bit more expensive. At age 65 and older it gets expensive quickly. If this 65-year-old couple waited until 2025 to make the gift and purchase the insurance, assuming no change of health, the amount of insurance they could buy would decrease by almost $10,000,000 for the same investment.

But what if their health deteriorated just a tiny bit, maybe they are both a Standard risk class as opposed to a Preferred risk class? The amount they could buy for the same investment would go down to just over $25,000,000. If the male in the couple became uninsurable, the coverage amount would drop further to $20,500,000. The risk of not acting today is real and the value of the desired legacy assets for generations to come could be meaningfully impacted.

Do you have clients that are taking a “wait and see” approach? If so, do they REALLY understand the risk of waiting and how much this could potentially cost them AND impact their legacy? If you would like AgencyONE to run some numbers for you to help move your clients to take action NOW, please call us!

Contact AgencyONE’s Marketing Department at 301.803.7500 for more information or to discuss a case.