Survivorship insurance policies (aka second to die) continue to be a very popular estate planning tool primarily because they are considered less expensive than issuing policies on a single life. In Survivorship insurance policies, this savings occurs because the insurance company can spread the mortality cost over two lives instead of one, and in most cases, over a longer period of time. The death benefit payout does not occur until the last person named on the policy dies. Unlike single life contracts which are used for income replacement as a result of the death of a breadwinner, or business needs such as key person replacement or funding a buy-sell agreement, these contracts are typically used in estate and\or legacy planning situations and are commonly owned by a trust.

Traditionally, Survivorship contracts were guaranteed policies with little or no cash value which would allow the client to lock-in a premium for the duration of the policy. With carriers discontinuing guaranteed Survivorship contracts from their portfolios, they have had to implement new competitively priced options. These new products are typically built on indexed chassis and have longer built in guarantees and offer cash value upside. What these newer indexed products have lost in guarantees, they have made up in cash value build up AND flexibility making them much more attractive than the fully guaranteed older products.

We can see the growing popularity of the indexed Survivorship products when we look at the options that are currently available in the marketplace:

- One current assumption Survivorship Universal Life (SUL) product

- Four guaranteed Survivorship Universal Life (SUL) products

- Eight indexed Survivorship products (some offer guaranteed premium design options)

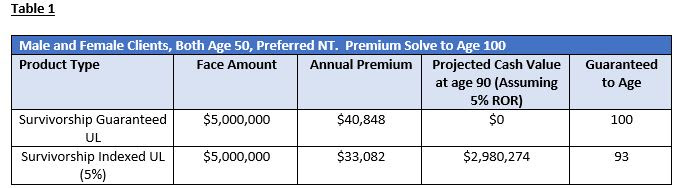

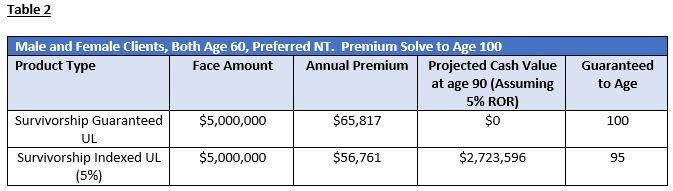

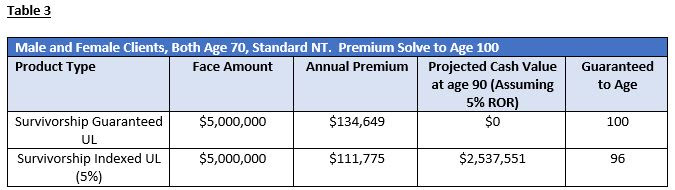

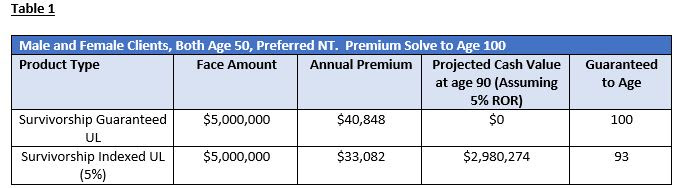

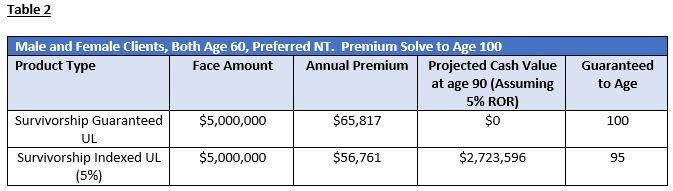

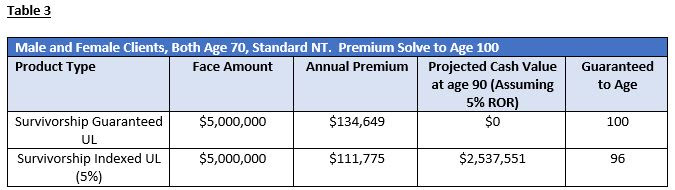

Each of the 3 tables below shows a comparison in premium, cash value and guarantees between a fully guaranteed Survivorship product and a new indexed Survivorship option for male and female preferred non-tobacco age 50 (Table 1), 60 (Table 2), and age 70 (Table 3). All examples are for a $5,000,000 face amount and have been solved to carry the policy to age 100.

In the three examples above, you see that the indexed Survivorship product has a lower projected annual premium compared to the fully guaranteed scenarios (14 – 20% depending on the ages illustrated). The indexed product has projected cash values, assuming a 5% illustrated return, of approximately ½ of the death benefit AND STILL offers guarantees up through the low to mid age 90’s. Annual policy reviews with your clients can identify any under-performing years which can be managed in order to continue coverage as required by your clients’ needs.

Every planning situation is unique and must consider all aspects of your client’s financial needs and goals but the next time you meet with your married clients, consider a Survivorship policy. You very likely will be able to insure the couple more cheaply than insuring them individually while also providing them with the flexibility that cash value build up offers.

AgencyONE’s Case Design team has the deep product knowledge and design expertise to provide cost effective solutions that meet all your clients’ needs.

Please contact AgencyONE’s Case Design Department at 301.803.7500 for more information or to discuss a case.