A Look Back & A Look Ahead

I am certain that many of you are happy that 2022 is over and that we are now 8 weeks into 2023, but, and this is a big but …. Is this year really going to be any different or will it present any fewer challenges than 2022?

Last year, most people were thinking about the economy and its impact on inflation and the equities market. Consumers watched their portfolio values go down, the prices of goods and services go up, and the supply chain present serious challenges. On top of this, the Russian invasion of Ukraine had a massive impact on fuel prices and created unease for global peace combined with China’s ongoing aggressiveness in the Pacific. This continues to create anxiety around financial security for many.

Notice that I did not mention the January 6th investigation, the mid-term elections, or the most recent House Majority vote. The US, despite the divisiveness and our ongoing political challenges, is still the US. Like all others, the US economy is cyclical and market forces are always at work, but it is still the most stable economy in the world.

Notice that I did not mention the January 6th investigation, the mid-term elections, or the most recent House Majority vote. The US, despite the divisiveness and our ongoing political challenges, is still the US. Like all others, the US economy is cyclical and market forces are always at work, but it is still the most stable economy in the world.

Economic forecasts for 2023 were all over the place. On June 1, 2022, Jamie Dimon, JP Morgan Chase CEO, said on CNBC:

‘brace yourself’ for an economic hurricane caused by the Fed and Ukraine war.

Then months later Barron’s Daily reported:

Take heart from JPMorgan Chase CEO Jamie Dimon. He clarified Tuesday that maybe he shouldn’t have said last year that an “economic hurricane” is coming. There are clouds for sure, but he didn’t mean to predict widespread collapse. His bank is still hiring.

Take heart from JPMorgan Chase CEO Jamie Dimon. He clarified Tuesday that maybe he shouldn’t have said last year that an “economic hurricane” is coming. There are clouds for sure, but he didn’t mean to predict widespread collapse. His bank is still hiring.

That notwithstanding, the direction of the market is either up or down, right? Maybe flat? But should that change the way comprehensive financial advice is provided to consumers relative to their financial security and retirement planning?

On the “good news” front, 2022 saw the COVID pandemic begin to wane, although new strains of the virus continue to emerge. We will see what the depths of the 2023 winter season brings but the death toll is WAY down and, not to minimize the impact, most people are breathing a little easier – no pun intended. During the COVID pandemic we saw a large increase in the demand for individual life insurance, but as 2022 rolled toward the end, the mortality “scare” began to fall off and Q3 sales were down year-over-year by 5%, according to LIMRA. Regardless, results through nine months were up 6%. Overall policy sales were down 12% in Q3 and 10% year-to-date (2022). The only product that experienced growth was Index Universal Life (IUL). It will be interesting to see how the year ended as the numbers are gathered and reported.

There are a FEW things, however, about the insurance industry that worry me both on the carrier\manufacturer side and on the distribution side.

There are a FEW things, however, about the insurance industry that worry me both on the carrier\manufacturer side and on the distribution side.

CARRIERS

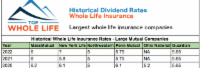

One would think that an increase in the 10-Year Treasury rate, which is a bellwether indicator for insurance investment portfolios, would be welcome news and to a certain extent it was. 10-Year Treasury rates increased from a bottom of around .52% in mid-2020 to its current level of 3.5% with a peak in late 2022 of 4.25%. It makes sense that new premiums received are invested in higher-yielding instruments and that the interest rate, passed onto policyholders in the form of interest or dividends, would go up. We certainly saw this in the annuity space, with its massive sales in 2022 and no end in sight as interest rates continued to increase.

On the life insurance side, it was a very different story. There was ONE company that I can think of that announced interest rate increases on their current assumption life product, and they did it twice during the year – that was John Hancock. To my knowledge, only one of the big mutual carriers increased dividends and this was Guardian, who increased dividends by .10% from 5.65% to 5.75%, while all the others held steady.

Life insurance portfolios do NOT move as fast as current interest rates. These portfolios are massive and the return drag due to years of low-interest rates will stay with us for some time. Think of the Titanic – you get it.

The bigger story is the impact that guaranteed products, such as GUL and certain annuity-guaranteed benefits, had on some insurers – notably Lincoln Financial who reported a $2.6BB loss on their Q3 earnings call.

“The loss was due mainly to a $2.2 billion increase in life insurance reserves, based on data showing that people ages 75 and older are more likely to keep guaranteed universal life insurance policies than the company had expected, and to a $634 million reduction in life insurance unit goodwill, according to the company’s earnings announcement.

The net loss will have no effect on Lincoln’s cash flow, but it will cut the company’s statutory capital by about $550 million in the fourth quarter, the company said.”

READ – Lincoln sold a lot of underpriced GUL policies to older-age clients and did not expect persistency to be as high as it is. Clearly there are other factors, but this is the ”nuts and bolts” of the challenge.

Prudential reported a similar write-down of over $1.4BB in Q2. Their announcement states that “This decrease includes an unfavorable comparative impact from our annual assumption update and other refinements of $1.408 billion, primarily driven by updated policyholder behavior and mortality assumptions in the current quarter. Excluding this item, current quarter results primarily reflect lower net investment spread results and higher expenses, partially offset by more favorable underwriting results.”

READ – they sold a lot of underpriced GUL policies to older-age clients and did not expect persistency to be as high as it is. Clearly there are other factors, but this is the “nuts and bolts” of this challenge.

There are other notable challenges related to these guaranteed benefits in the recent past, such as Ohio National, which was ultimately sold to Constellation Insurance, a Canadian insurance holding company for $1BB with money from public pension plans. Their problem was primarily driven by Guaranteed Withdrawal and Income benefits resulting from their legacy Variable Annuity book, among other things.

There are other notable challenges related to these guaranteed benefits in the recent past, such as Ohio National, which was ultimately sold to Constellation Insurance, a Canadian insurance holding company for $1BB with money from public pension plans. Their problem was primarily driven by Guaranteed Withdrawal and Income benefits resulting from their legacy Variable Annuity book, among other things.

Principal Financial Group exited the individual life business and are focused on the business owner market. American National recently exited the term business market …. I could go on and on.

The market is challenging for insurance companies, but not really because of current economic conditions. They are shoring up financial reserves due to past mistakes in pricing and persistency assumptions and trying to find a balance in an increasing interest rate environment after years of decreasing portfolio returns. Remember that the value of bonds purchased in the last years are meaningfully impacted due to a sharply rising interest rate environment. As a wise industry analyst once said to me “the insurance business is a LOOOOOONG business and mistakes from 10, 20 or even 30 years ago can come back to bite you in the behind”.

This is not to say that the industry is facing existential challenges. Statutory capital for the industry is generally strong and contractual guarantees are safe – they are just not profitable for the issuing carriers. Stock companies care about this more than mutual companies.

I expect to see more exits from the guaranteed benefits space, including long duration term insurance, or at a minimum, continued price increases. I also expect to see a tightening in underwriting offers.

One last comment, which is pure speculation on my part, is that while the insurance industry is trying to find a way to expedite underwriting through algorithmic processes and big data, the longer-term impact on mortality is yet to be determined. It is just too soon to tell what the impact of these algorithms and all this automation will be. They can afford to make some mistakes if they can cut significant expenses through automation, but only time will tell.

DISTRIBUTION

This is likely the biggest story of 2022. It is no secret that the advisor community is aging, as is the ownership of Brokerage General Agencies (BGAs) and Independent Marketing Organizations (IMOs). Private equity has fueled a ton of Merger & Acquisition (M&A) activity in many areas of our profession, including the retail Investment\Wealth Management space. In this space, advisors are seeking independence from career insurance platforms such as Northwestern, Mass Mutual, New York Life, etc. and also from the large wires such as Wells, UBS, and so on.

(IMOs). Private equity has fueled a ton of Merger & Acquisition (M&A) activity in many areas of our profession, including the retail Investment\Wealth Management space. In this space, advisors are seeking independence from career insurance platforms such as Northwestern, Mass Mutual, New York Life, etc. and also from the large wires such as Wells, UBS, and so on.

Similarly, the insurance distribution arena has seen massive consolidation, specifically in the aggregator space. Companies like Integrity, Simplicity, AmeriLife and others, fueled by private equity firms such as Aquiline, Silver Lake, Harvest Partners, Lee Equity Partners and Genstar Capital are buying everything in sight. Of particular note, in 2022 alone, Integrity Marketing acquired notable firms in the insurance space such as Ash Brokerage, One Resource Group, Lion Street and Annexus.

Firms such as Gallagher, Acrisure, HUB and others like them have also entered the wholesale distribution of individual life and health insurance, primarily through their presence in the Employee Benefits and Property\Casualty space.

Even the association space has experienced consolidation, as we saw Finseca merging with the Forum 400 and the National Association of Life Brokerage Agencies (NAILBA), to add to their previous merger with the General Agents and Managers Association (GAMA). Finseca now stands as the preeminent representative of the financial security profession. If you are not a member, you should be.

Even the association space has experienced consolidation, as we saw Finseca merging with the Forum 400 and the National Association of Life Brokerage Agencies (NAILBA), to add to their previous merger with the General Agents and Managers Association (GAMA). Finseca now stands as the preeminent representative of the financial security profession. If you are not a member, you should be.

Finally, consolidation of the IMO has also occurred. AgencyONE is privileged to be a partner of LIBRA Insurance Partners, an organization of which I am on the Board. During the last two years, LIBRA has successfully merged with two other IMOs, Brokerage Resources of America (BRAMCO) and Insurance Designers of America (IDA), forming the largest independently owned insurance distribution company in the United States with $600MM of life insurance premium production and close to 100 firms.

Consolidation is happening right in front of our eyes. Having been through a wave of this before in the late 90s and early 2000s, I have witnessed the good, the bad and the ugly of this sort of market dynamic. While it is an exciting time for many, the consolidation of insurance distribution is here to stay and will create both challenges and opportunities.

TECHNOLOGY

This is another area where we saw great strides in 2022 as we came out of the COVID pandemic. As many of you know, the pandemic created an environment where meeting with clients and taking applications in person, never mind getting people examined for insurance, was problematic. In spite of this, applications and premiums during 2021 increased due to the high demand for life insurance caused by the pandemic. As mentioned before, while business was down industry-wide, carriers committed to getting on the technology bandwagon.

applications in person, never mind getting people examined for insurance, was problematic. In spite of this, applications and premiums during 2021 increased due to the high demand for life insurance caused by the pandemic. As mentioned before, while business was down industry-wide, carriers committed to getting on the technology bandwagon.

Insurance companies accelerated their technology spend and projects in a massive way, as did many providers in the big data space, specifically around prescription checks and electronic health records. 2022 was, in a sense, a frustrating year as the launching and “de-bugging” of a lot of this technology happened. The digital end-to-end process for insurance is here – from application to delivery; the so-called pain points of applying for life insurance are being substantially removed and there is no going back.

Similarly, massive amounts of spending have occurred on the in-force policy servicing side with many carriers creating a much more robust process for client service. While still not great, some companies are shining while others are struggling to get on board. This will further differentiate who you should consider doing business with going forward.

AgencyONE

AgencyONE had a great year in 2022 and we would like to thank all of you who supported our growth and selected us as a partner to help serve the financial security needs of your clients. We have a lot of plans for 2023 but will continue to focus on “serving a small group of insurance advisors in a very big way” as is our mission.

AgencyONE had a great year in 2022 and we would like to thank all of you who supported our growth and selected us as a partner to help serve the financial security needs of your clients. We have a lot of plans for 2023 but will continue to focus on “serving a small group of insurance advisors in a very big way” as is our mission.

As I look at our profession, I see an inflection point. A lot of it driven by the demographic changes and the massive wealth transfer happening right before our eyes. The financial services and financial security profession will either continue to jockey for position or finally come together to serve the American consumer more holistically. If we are not careful, however, the risk of commoditization will continue to impact our livelihood. We cannot measure ourselves by the cheapest price, the lowest fees, or the highest investment returns.

Consumers want a financial guide or coach and don’t want to have multiple people advising them in different lanes. Collaboration amongst advisors (Accountants, Attorneys, Investment Advisors and Risk Management Advisors) will be key, allowing each to play their specific and very important role. AgencyONE wants to be at the forefront of this collaborative effort.

Our Annual Advanced Markets and Underwriting conference took place on April 30 through May 2 at the iconic Dupont Circle Hotel in Washington DC. At all of our conference events, you can expect to see what we have delivered for many years – excellent speakers and topics, great networking with some of the best insurance professionals in the country and a little bit of fun along the way. The event was well received, and we look forward to hosting another successful conference in 2024!

To further our objective of collaborative planning, in November 2022 we experimented with a High-Performance Collaborative Teams meeting in Boston. We made mistakes, we learned a lot, and the meeting validated our belief that collaborative planning is good for the client and produces more and better referrals for the life insurance advisor. We will continue with this one-day training in San Diego on March 1 and have another event after our Annual Conference on May 3 in Washington, DC.

Finally, during 2022, AgencyONE launched our Insurance Network for Fiduciary Advisors (www.in4fa.net). This is a collective of carefully selected insurance-only advisors who will work with the RIA\CFP Fiduciary market to assist them with the risk management needs of their clients. Again, collaboration.

Thank you again for your continued support and friendship. We look forward to a successful 2023.

Please contact AgencyONE’s Marketing Department at 301.803.7500 for more information or to discuss a case.