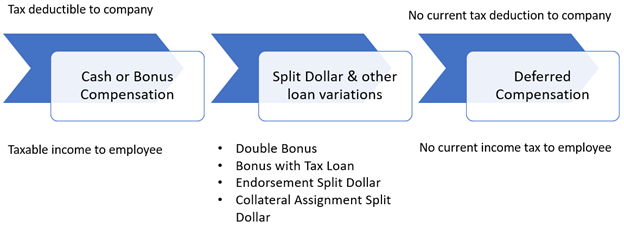

The Tax Continuum

“I have a client who wants to implement a Deferred Compensation Plan”.

I cannot count the number of times, over the course of my career, that I have had a call from an Advisor making this request. Upon asking a few questions and having a short discussion, I typically get the reply “no, that is not what they actually want”. I am not saying that Non-Qualified Deferred Compensation arrangements are not effective; they are. However, the business circumstances often contradict that solution. Many of the same objectives can be accomplished more simply in a small to mid-size business environment.

I was prompted to write about executive benefits in this ONE Idea as a result of a recent conversation I had with Tracey Ullom, JD, LLM, CLU from the John Hancock Advanced Markets department. Tracey shared that during the first quarter of the year, the most frequent inquiry that the department received was about executive benefits, replacing the typical inquiries on estate planning. I call that a leading indicator which warrants my, and hopefully your, attention.

I refer to the chart below as “The Tax Continuum”.

This chart provides me with a line of questioning to determine the priorities of the inquiry or request from the advisor with a business owner client.

Entity/Business Structure

My first response to the inquiry “my client wants a deferred compensation plan for him(or her)self and for certain key employees” is around the business entity structure. Is the business a C-Corporation or a pass-through entity? Advisors don’t always ask the client this question, and it is critically important to know this one fact. Ask the client; they will tell you. Most small businesses in the United States are pass-through entities (S-Corporations, LLCs, Partnerships, or Sole-Proprietorships) and the balance of this ONE Idea will address pass-through entities.

I will start with the obvious. If the business is a pass-through entity (S-Corporation, Partnership, Sole Proprietorship, or LLC), there is no point in discussing a “non-qualified deferred compensation plan” for the business owner(s).

An example will illustrate this point:

John is 100% owner of an S-Corporation. He:

- Takes a $250,000 salary (W-2 income) from the business and,

- Has payroll expense for his employees of $1,000,000, of which,

- A key employee, Jill, is $200,000 of that, and,

- The remaining $800,000 is paid to 10 other employees, and

- After deductible expenses, John has a profit of $500,000, which is reported as “pass-through” income to him on IRS Schedule K-1 of Form 1120-S.

There is no way for John to “defer” pass-through income, as any profit will be passed through to him on his K-1. It is circular logic in a sense. IF John wanted to defer $50,000 of his $250,000 W-2 income, it would reduce his payroll expense by $50,000 and increase his profit to $550,000, leaving him with the same amount of taxable income. One could argue that it would save him the payroll taxes on this $50,000, which is John’s right to do, but John should be careful to pay himself a reasonable salary commensurate with his title and duties. Otherwise, he may be challenged by the IRS.

But what about the non-business owner employee? This scenario requires a DIFFERENT conversation if John wanted to create a non-qualified deferred compensation plan for his key employee, Jill, as a retention and reward tool. In this scenario, there is another key question that the advisor MUST ask John.

Is a current tax year deduction important?

If John allowed Jill to “defer” compensation, reducing her salary from $200,000 to $150,000, as an example, and have John’s company establish a Deferred Compensation account for Jill, it is John that will pay taxes in the year of deferral because it will increase his K-1 by the same $50,000.

Alternatively, if John told Jill that he would pay her the same $200,000 and “fund” an additional $50,000 into a Deferred Compensation plan, he would have a similar problem. (I used quotation marks because Deferred Compensation plans are, by definition, an unfunded promise to pay). His K-1 would still be $500,000, but he would have $500,000 in cash and a $50,000 liability. Contributions to a Deferred Compensation account are not deductible.

Most successful business owners are looking for current income tax deductions to reduce their current income tax liability. However, some business owners may find that the additional personal tax burden incurred is worth it to retain and reward a valuable employee. In these situations, a Deferred Compensation plan would be an excellent solution. John will eventually enjoy the tax deduction of the compensation payments, just not today.

What about the Balance Sheet and Profit and Loss (P&L) statement?

Some businesses need a strong balance sheet and P&L statement due to banking or other financing arrangements. We typically see these requirements with real estate developers, car dealerships, or any business that generally finances their inventory, as examples.

Because these financing arrangements are an agreed-upon promise to pay something in the future, Deferred Compensation plans create a liability on the balance sheet and can create a charge against earnings on the P&L statement.

Furthermore, many Deferred Compensation plans are “financed” with corporate-owned life insurance (COLI), which can also carry some early year charges against earnings. There are high, early cash value insurance solutions that can solve this problem, however.

The benefit of COLI is that it acts as a tax-deferred asset on the balance sheet, with P&L benefits, and provides long-term cost recovery of the cost of the plan. While the cost-recovery feature is often promoted as a benefit, the reality is that generally, the business owner will be long retired or possibly not alive when the benefits of the life insurance are received by the company. I am not convinced that in the small business setting this is a meaningful benefit.

The administration and accounting of these plans can be complex and will have an impact on the business’s financial statements. As such, a third-party administrator should be retained.

What about Regulatory Compliance?

Section 409A of the Internal Revenue Code, which became effective in January of 2005, outlines the rules for taxing non-qualified deferred compensation arrangements, requiring adherence to specific timing and form of payment, while imposing penalties for noncompliance.

If Section 409A requirements are not met, the deferred compensation is included in the employee’s gross income in the year it becomes available, along with an additional 20% excise tax and interest.

The complexity and consequences of 409A are one more reason that competent counsel and a third-party administrator should be hired when considering such a plan.

What About Employee Considerations?

When employees receive deferred compensation payments, just like in a pre-tax 401K plan, all deferred income plus growth is taxed as ordinary income. This is not necessarily a bad thing, but if a key employee has done well with their 401k or other investments, they may not necessarily want more taxable income when they retire.

On another note, a participant in a non-qualified deferred compensation plan is a general creditor of the company. If the company becomes bankrupt or requires reorganization, some or all the account may be forfeited.

Concluding Comments on Non-Qualified Deferred Compensation Plans

Non-qualified deferred compensation arrangements can provide meaningful benefits to a key executive for retention and reward purposes, but they are not without their risks and complexity, as seen above.

This takes me back to The Tax Continuum. There are a variety of non-qualified executive benefit arrangements that can provide meaningful benefits to key employees, offering:

- a much simpler administrative environment;

- less regulatory risk;

- current tax deductions;

- either cost recovery or a future tax deduction;

- no corporate balance sheet liabilities;

- much less creditor risk for the employee; and

- tax-free income or death benefits for the employee & beneficiaries.

These programs can be classified as bonus or split-dollar arrangements with all the variations that they bring. More often than not, the conversation that started with the statement “I have a client that wants to implement a Deferred Compensation Plan” turns into a very effective split dollar plan for BOTH the Employer and the Employee.

AgencyONE routinely has these conversations with our advisors and helps them implement the RIGHT plan for their business owner clients. In our May 2025 Advanced Markets ONE Idea, I will dive further into split-dollar arrangements.

Contact AgencyONE’s Advanced Markets Department at 301.803.7500 for more information or to discuss a case.