Unlocking Value in Joint LTC Case Design

It’s been the summer of hybrid long-term care cases for AgencyONE’s case design team. We are running numerous quotes for our advisors daily. The hybrid LTC market has taken off in terms of activity and new competitive product offerings. Given the significant interest in these solutions, I’d like to highlight some of the key points in Joint Hybrid LTC policy design, including:

- Addressing the premium objection, or designing coverage to maximize value

- Leveraging qualified funds (IRA, HSA) to pay for the coverage

- Comparing Joint Hybrid LTC to Survivorship Universal Life (SUL) with an LTC rider

- The flexibility to include an adult child as an insured, creating long-term care protection for both generations

This week’s ONE Idea will discuss the two carriers that offer very strong Joint LTC options – OneAmerica & Nationwide. Let’s look at the options that are typically run with each carrier.

OneAmerica Asset Care (2024) Joint Life: Reimbursement LTC

When looking at Joint LTC cases it is important to know that the total benefit period is shared with both clients. If one insured uses the full duration, the second client could be exposed to their own LTC costs.

While this can be designed to fit the client’s estate planning, it can also be avoided. OneAmerica’s unique lifetime uncapped benefit provides unlimited coverage for both clients – they can even be on claim at the same time for the full monthly benefit.

Let’s look at a sample case run a few different ways for Mr. and Mrs. Douglas who are both 55 years old.

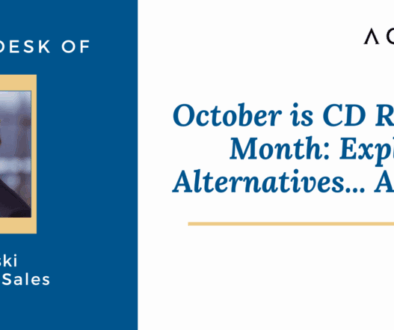

OneAmerica – Option 1: The “GOLD” Plan

This plan allows for a $10,000 initial monthly benefit that increases every year and is available for each client via a pool of benefits that can never be exhausted. With premiums paid to age 95, the annual cost is $22,481. Alternatively, the policy can be structured as paid-up in 10 years, with annual premiums of $45,727 creating a guaranteed lifetime pool of benefits.

If the illustrated premium is too high for the client’s budget, consider reducing the COLA or using a shorter benefit period on the same monthly benefit to lower costs. While those adjustments may help, they may not always be the best solution. The alternative design below offers another way to lower cost without impacting COLA or benefit duration.

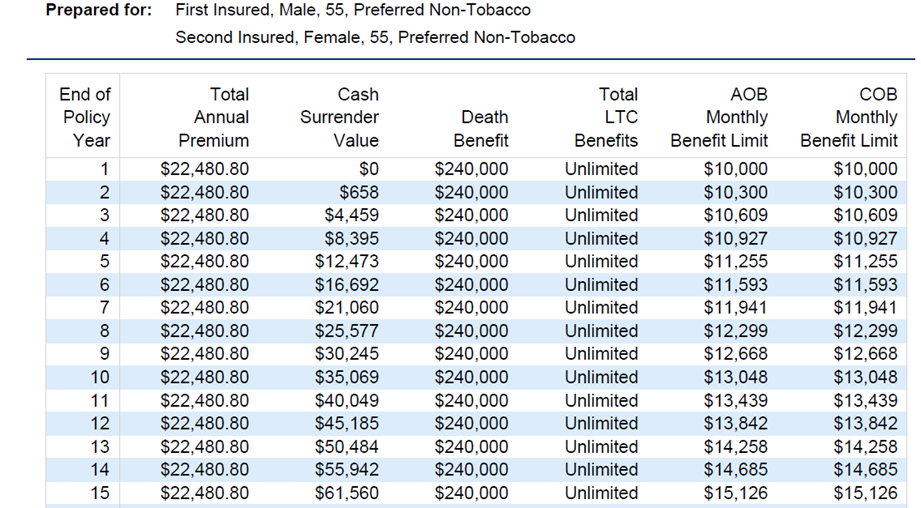

OneAmerica – Option 2: The “Silver” Plan

To help the client achieve the desired benefit with a lower premium, the case design team targeted a specific age and benefit amount. Compounding then ensured the benefit would grow to meet the client’s goal at the designated age. For example, targeting a $10,000 monthly benefit at age 70 allows us to begin with a $6,800 monthly benefit today, while still applying 3% lifetime compounding and maintaining an unlimited benefit period. With this design, the premium to age 95 drops to $15,287 per year and the 10-pay lowers it to $31,095 a year. We are seeing more designs that target a future benefit amount as a cost-efficient way to meet client goals.

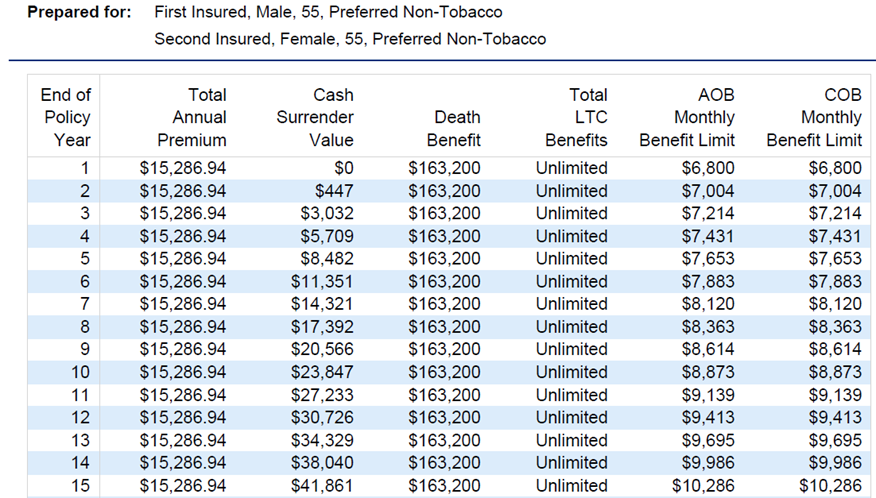

OneAmerica – Option 3: What if your Clients want to use Qualified Money? (Another “Gold” Plan)

For your clients over age 60 who have a large, qualified pool of money, OneAmerica has an option to use one client’s pool of funds to purchase a policy on both the client and spouse. In this case, we have two clients, both 65 years old, who want a $10,085 monthly benefit on each with a lifetime benefit period. No inflation riders are added. The client with the qualified money uses $275,000 to fund the 10-pay annuity purchase. OneAmerica applies a 25% premium bonus of $68,750 to the annuity. This creates 10 annual distributions of $34,375 with taxes due annually on this amount. This program does everything internally at OneAmerica, so no additional fund transfers are required. After 10 years the policy is fully funded and paid up. The linked sales idea from OneAmerica, Use IRA dollars to fund Asset Care, outlines a policy funding strategy using a client’s IRA distributions to pay the required premiums.

Nationwide CareMatters Together – Indemnity LTC

The CareMatters Together product is an indemnity LTC option that provides a pool of monthly benefits that are shared by the insureds. Your clients can purchase 48, 72 or 96 months of LTC benefit.

Let’s take another look at Mr. and Mrs. Douglas, both age 55, using the Nationwide CareMatters Together solution.

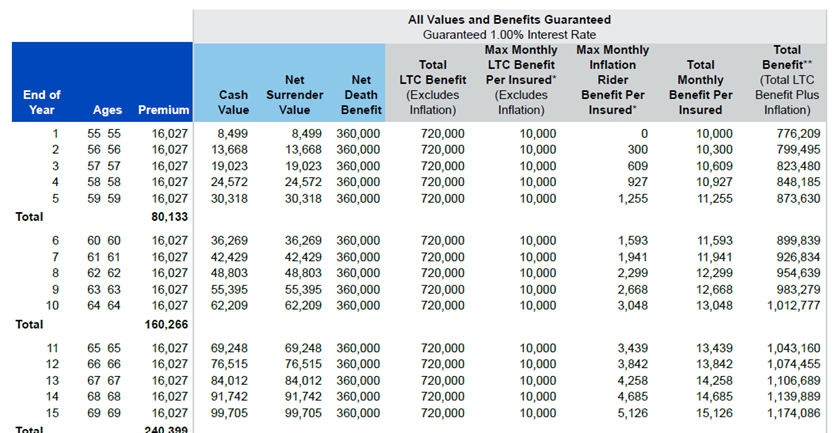

Nationwide – Option 1: The “GOLD” Plan

This design allows for a $10,000 monthly benefit for each client with 3% compounding for lifetime and a shared benefit period of 72 months. With the compounding, this policy will continue to grow for the insureds’ lifetime with payments stopping at age 100. The pay-to-100 premium is $16,027 and the 10-pay premium is $30,558.

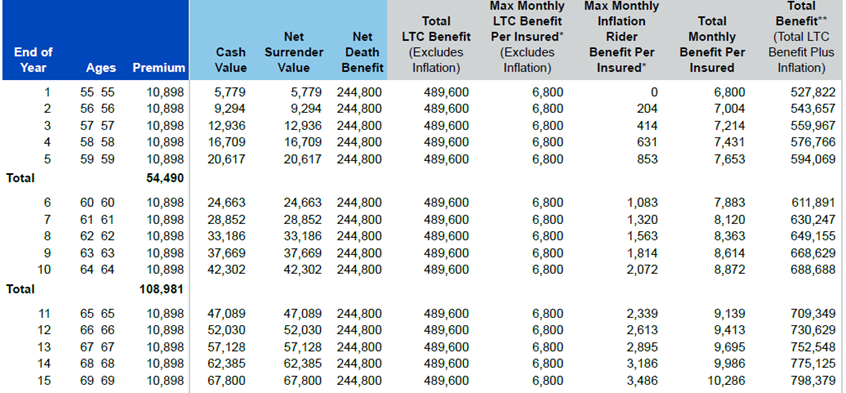

Nationwide – Option 2: The “Silver” Plan

Next, let’s look at the smaller initial benefit and allow the compounding to grow to $10,000 per month by age 70. In this design, we begin with a $6,800 monthly benefit, apply 3% lifetime compounding, and use a 72-month shared benefit. The pay-to-100 premium drops to $10,898 annually while the 10-pay lowers the annual premium to $20,779. AgencyONE is seeing more cases designed around a future benefit amount which help to provide a more cost-efficient path to meeting long-term care goals.

These hybrid LTC options can be built with or without protection against inflation. Reviewing both options allows you to compare benefits at different ages and identify the strategy that works best for your client’s needs and long-term financial goals. While I did not discuss available death benefits above, any LTC benefits used will reduce the policy’s death benefit dollar-for-dollar until it reaches a guaranteed minimum death benefit to keep the contract in force.

If a death benefit is the primary goal and adding LTC would be a useful addition, we can consider Nationwide’s SIUL with an LTC rider – the only joint life product with an LTC rider available in the marketplace. This product is an indexed SUL that allows the addition of a guaranteed death benefit rider up to age 70 while the LTC rider is available for ages 35-75. This LTC rider allows each client to access up to 50% of the death benefit. The monthly LTC amount is level with no inflation available and provides 50 months of indemnity benefit. The death benefit is reduced by the amount of LTC payments made. For our 55-year-old couple, $1,000,000 of death benefit Guaranteed to age 105 will cost $13,336 per year to age 105. The 10-pay will cost $30,331. The monthly benefit limit is $10,000 for 50 months – allowing $500,000 of the death benefit for LTC per insured.

Nationwide – Option 3: The “Second-to-Die Life Insurance with LTC Rider” Plan

Finally, let’s consider Nationwide’s joint life SGIUL with the LTC rider which can help meet the needs of older clients who want to:

- Provide for their own LTC needs.

- Help an adult child (instead of a spouse) plan for future LTC coverage.

- Provide a legacy for the next generation if LTC benefits are not used.

Keep in mind that long-term guarantees are only available if the oldest client is below 70 years old. The LTC rider is only available for ages 35-75. Issue ages and underwriting are extremely important in this design.

Mrs. James is 70 years old, and her adult son is 35. She wants to plan for her own possible LTC needs and help her son plan for any future coverage he might require. For $1,000,000 of coverage guaranteed to the younger client’s age of 105, the premium at a preferred rating is a 10-pay of $35,170. Short pays work best for this design to provide a paid-up policy for the younger client.

Each client has a pool of $500,000 for LTC needs (50 months of $10,000). This approach provides LTC for the mother, while also offering her son a paid-up policy that includes LTC benefits that he can access anytime in his life. Any unused LTC benefits are payable as a death benefit to the policy beneficiary. The linked Nationwide case study examines how a senior parent can use a SGIUL with an LTC rider to protect both their own needs and those of an adult child.

At AgencyONE, we’re committed to keeping our advisors informed and equipped with the best solutions. Together, we can help your clients protect what matters most and confidently plan for their future.

Contact the AgencyONE Case Design department at 301.803.7500 for more information or to discuss a case.