A Simple Solution to the Estate & Gift Tax Quandary

There are many wealthy clients that know that the window to make substantial gifts, and thereby reduce their estate tax liability, is closing due to proposed changes in the estate and gifts tax regimes. In fact, those in estate planning circles having been discussing this for months. There is a simple solution to the Estate and Gift Tax quandary that your wealthy clients need to know. Before we explore the solution, let’s look at the reasons taxpayers may not have acted in 2020:

- Their attorney was too busy doing the same planning work for other clients and could not get to them before year end;

- They did not believe that Joe Biden would win the election;

- They thought that there would be a divided Congress and there would be continued gridlock in Washington; or

- They simply kicked the can down the road for some other reason.

The Estate & Gift Tax Quandary

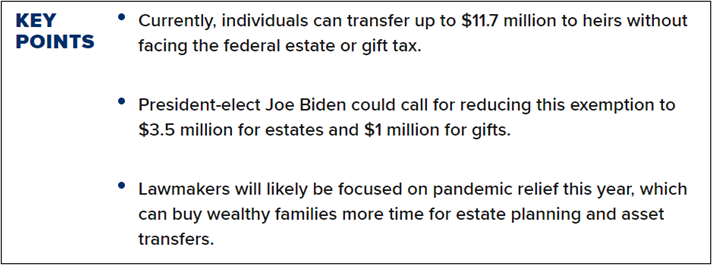

The BIG quandary now, for those taxpayers that did not take action, is that if meaningful gifts are made in 2021, will the law be retroactive to January 1, 2021, potentially causing a massive gift tax due in 2022? In the linked article by Bob Dietz and Tom Pauloski titled Could a Change to the Gift and Estate Tax Exclusion Be Retroactive, the authors discuss this problem. They address the issue of a change in the Basic Exclusion Amount going from the current level of $11.7MM per taxpayer down to $3.5MM per taxpayer under the Biden Proposal. What they do not mention however, as it relates specifically to the gift tax exclusion, is that under the proposal the Biden administration would de-couple the estate and gift tax regimes and REDUCE the Gift Tax Exemption to $1.0MM, while the Estate Tax Exemption would be REDUCED to $3.5MM. This of course would cause a bigger gift tax problem still. See CNBC article dated January 22, 2021 titled Here’s How Wealthy Families Will Save on Estate Taxes in the Biden Presidency.

We Have A Solution

To provide the intended result of gifting over $1MM without the risk of being subjected to a gift tax should the law become retroactive to January 1, 2021; we have a solution.

With the current Biden tax proposal being a reduction in the gift tax exemption to $1 million with an estate tax exemption of $3.5 million it seems as though prudent planning would be to make immediate gifts to take advantage of the current $11.7 million gift tax exemption. However, with even the possibility of such a tax bill being retroactive, as unlikely as many advisors consider that possibility, is it wise to pursue that course of action?

To Gift or Not

Imagine the following scenario: A taxpayer makes a gift of $3,500,000 to a trust in March of 2021. The “Biden Tax Act” is passed sometime later in 2021 and is made retroactive to January 1, 2021 with a $1MM gift tax exemption. The taxpayer\grantor is now in a situation of potentially having to pay $1,000,000 in gift taxes on the difference between the $1,000,000 gift exemption and the $3,500,000 gift made. ($3,500,000 – $1,000,000 = $2,500,000 at a 40% gift tax rate equals $1,000,000 gift tax).

Of course, on the other hand, not making gifts in the current environment will almost certainly be a wasted planning opportunity. Why? Because it is difficult to imagine that a tax bill lowering the exemptions to at least the $5 million (with indexing to about $5.9 million) level is not a near certainty before the 2022 elections when a closely divided Congress could once again change hands, thereby making tax legislation for the Biden Administration much more difficult.

What To Tell Your Client

So, what should a prudent advisor tell his or her affluent clients? Well, for affluent clients, it seems clear that making a gift of $1 million is safe. A husband and wife, age 60 and 55, can purchase about $5 million of second to die insurance for $1 million. That is very powerful leverage!

However, what about those clients with very large estates – a simple $1 million gift strategy will do little to reduce the estate tax exposure and create liquidity for payment of taxes. What the possibility of a retroactive tax bill is likely to do is slow down the planning for those clients that really should be planning. When Congress eventually does get taxes on the table – it could happen quickly. In fact, many in Washington feel like a tax increase could be tacked onto another bill to offset costs for purposes of avoiding filibuster in the Senate. Could a tax bill be tacked onto an infrastructure bill?

Take Action Now

Whether the tax bill that is surely coming down the pike is retroactive or NOT, one thing is certain. Your clients should take action NOW, because they risk either not having time to do planning before a retroactive tax bill takes effect or suffering the effects of a new tax bill again, without having the appropriate planning in place. And the action that your client can take NOW is to get his/her plan teed up via loan strategies. Let’s look at a case study.

Estate & Gift Tax Planning Using Loan Strategies

Maggie May is 75 years old. She is recently widowed. Maggie and her husband were successful real estate developers. She has a mostly illiquid estate valued at approximately $40 million. The properties are growing at about 8% a year, including cash flow of about $2 million. Maggie’s estate planning attorney has suggested that her real estate holdings be transferred into one or more limited liability companies (LLCs). These LLCs would restrict transfer in such a way that her attorney suspects a valuation firm will discount minority ownership interests by about 40%. The attorney is then suggesting that Maggie sell a substantial portion of these interests to an irrevocable trust that is ignored for income tax purposes (what some people might unfortunately call an “IDIT” or “defective trust”). If Maggie transfers her property into LLCs and gets a qualified appraisal with a 40% discount – she will have reduced the value of her estate considerably. For the sake of discussion, we can now assume the value of the estate for estate tax purposes would be about $24 million.

Gift, Sale, Cash for Life Insurance

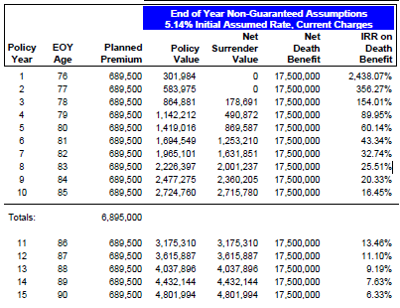

If Maggie makes a $1 million gift to her LLC and then sells another $9 million of this property to her trust, she will have reduced her taxable estate to $14 million. Her cash flow from the retained assets would still be $1.167 million in year one and increasing. The sale of the LLC interests would be at the current Applicable Federal Rate (AFR) which is 1.6% — generating another $144,000 in potential cash flow to Maggie (if needed). But, even after the trust pays interest (which is not income taxable) to Maggie, it will have cash flow of about $689,500 (5% of the underlying trust assets valued at $16.67 million before transfer to the LLC and discounted less the $144,000 loan interest). This cash flow within the trust could be used to purchase life insurance on Maggie’s life. Depending on the product and underwriting class – $689,500 could purchase about $17,500,000 of death benefit on a tax-free basis outside of Maggie’s estate. And, by potentially using a premium financing strategy to reduce out of pocket cost, additional leverage could be created and additional insurance purchased by the trust.

retained assets would still be $1.167 million in year one and increasing. The sale of the LLC interests would be at the current Applicable Federal Rate (AFR) which is 1.6% — generating another $144,000 in potential cash flow to Maggie (if needed). But, even after the trust pays interest (which is not income taxable) to Maggie, it will have cash flow of about $689,500 (5% of the underlying trust assets valued at $16.67 million before transfer to the LLC and discounted less the $144,000 loan interest). This cash flow within the trust could be used to purchase life insurance on Maggie’s life. Depending on the product and underwriting class – $689,500 could purchase about $17,500,000 of death benefit on a tax-free basis outside of Maggie’s estate. And, by potentially using a premium financing strategy to reduce out of pocket cost, additional leverage could be created and additional insurance purchased by the trust.

Importance of Pre-Planning

If the gift and estate tax exemptions are not reduced, at some point Maggie could forgive the note and use her lifetime exemption. But, most importantly, this will be especially important if legislation is introduced that is not retroactive but has a very short window. What is more likely than retroactive legislation is a tax bill that becomes effective immediately upon passage. And, if tax law is added to other legislation as part of reconciliation, this window would be only days. Having the property already in the LLC, appraised and transferred to the irrevocable trust, puts Maggie and her advisor in a position where they can literally complete the gift immediately by simply forgiving the note from the trust to Maggie. Those clients that wait until they see the introduction of what is likely a certain tax bill will be in a queue with their advisors that will very possibly prevent them from meeting what could be a very short timeline.

Interest Rates & Trusts

With today’s low interest rates, selling assets out of a taxable estate and into an irrevocable trust outside of the estate tax is prudent planning! If a client can earn even a modest return on the assets sold, the client and their family will be able to move the appreciation out of the estate tax system. With a 1.6% AFR – assets earning 6.6% will grow by 5% (after loan interest payment) outside of the estate. The trust can use this appreciation to purchase life insurance or to reinvest. But, given the uncertain tax environment we find ourselves in today, this type of planning seems an almost necessity for affluent clients.

As mentioned in the beginning of this article, many wealthy individuals and families had intentions of taking advantage of the incredible opportunity to move assets out of their estates in 2020 but did not, or could not, act. The environment has changed adding some risk that was not there prior to a Democratically controlled White House and Congress. Flexibility and nimbleness IS the name of the game today.