A Worry for All – New Proposed Tax Law

In a New York Times article entitled It May Be Time to Start Worrying About the Estate Tax the author, Paul Sullivan, addressed the challenge of the lost step-up in basis on assets that have been transferred at death as his main point. This eventuality should be a worry for ALL taxpayers, not just for the very wealthy, because the new proposed tax law IS NOT really an estate tax. Let’s call it what it is – a CAPITAL GAINS TAX.

CAPITAL GAINS UNDER THE CURRENT LAW

By way of example, imagine that Generation 1 purchased a house 30 years prior at a price of $100,000. Assuming no basis adjustments, which could have occurred due to improvements to the home or property (but…keep your receipts!), Generation 1 passes away and the children inherit the property – now valued at $500,000. The children have their own homes, have no interest in living in their parents home, and decide to sell this house. Under current law, the children would enjoy a new basis of the home’s value upon the death of their parents – in this case $500,000 – the so called “step-up in basis”. If they sold the house for that price, the children would pay ZERO Capital Gains tax.

CAPITAL GAINS UNDER THE NEW LAW

Under the new proposed law, which not only has the attention of President Biden, but as the New York Times article suggests, is also being examined by our new Treasury Secretary, Jane Yellen, the children would have a Capital Gain of $400,000! Depending on the Capital Gains tax rate, they could pay as much as $160,000 in taxes on the sale of the home (at 40%) and divide up the net of $240,000 amongst the siblings.

CAPITAL GAINS & A FAMILY-OWNED BUSINESS

This same scenario could occur with the sale of a family-owned business or a stock portfolio, or generally any other asset, that can experience untaxed capital appreciation. While this scenario is serious for many taxpayers, it may be even more so for those who are considered wealthy and have an estate tax due. The confiscatory nature of transfer taxes can take a tremendous bite out of an estate.

FAMILY-OWNED BUSINESS CASE STUDY

FAMILY-OWNED BUSINESS CASE STUDY

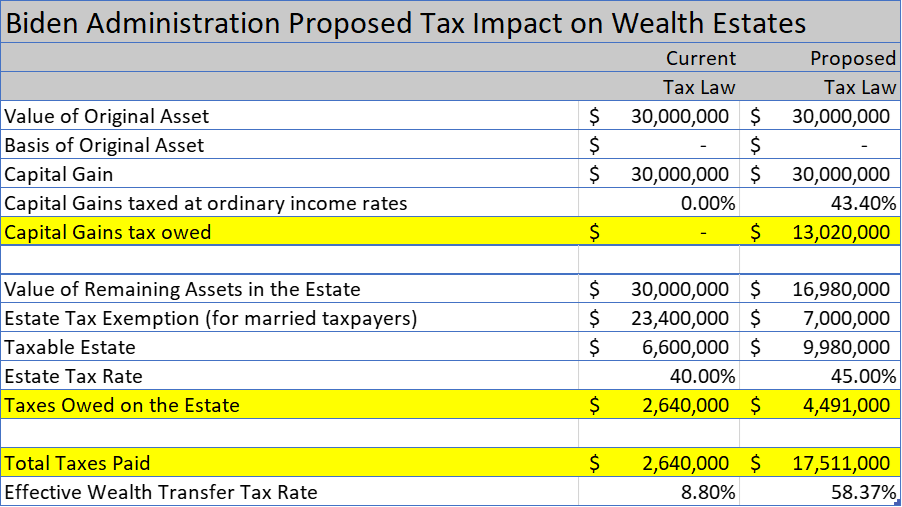

Consider the following example of a business owner couple who has grown the value of their company to $30,000,000. Most businesses will have fundamentally depreciated most of their assets and may have zero or a near-zero basis. Furthermore, let us assume that President Biden has been successful in reducing the estate tax exemption to the proposed $3,500,000 per individual taxpayer, or $7,000,000 per couple and increased the estate tax rate to 45%.

The chart below shows the REAL impact of the proposed tax law changes being considered under the Biden administration. The “big deal” is the Capital Gains Tax, even though the asset would also be part of the couple’s taxable estate. The estate confiscation would be north of 58% after paying $17,511,000 in wealth transfer taxes.

PROPER ESTATE PLANNING

There are many planning solutions available to address these tax problems. With proper planning, many estates can reduce their tax bill significantly, if not entirely! As I have always stated, wealth transfer taxes are a voluntary or, maybe better described, an ignorance tax in the United States. In this case, what you don’t know CAN and WILL hurt you…financially.

Regrettably, it is the uninformed taxpayers or those who choose to “stick their heads in the sand” who end up with taxable estates that result in a very heavy burden for their unsuspecting heirs. Estate planning professionals, attorneys, accountants, and a variety of financial advisors have been working around the transfer tax system for many years. Their knowledgeable assistance should be sought to ensure that your clients’ estates are protected and properly managed.

AN OPPORTUNITY FOR FINANCIAL ADVISORS

To that end, AgencyONE has created a brief presentation for use by financial advisors, which is generic, succinct, and can be delivered to consumers on a variety of platforms. AgencyONE is happy to brand this presentation with your firm’s logo and contact information. This presentation can also be delivered virtually by an AgencyONE professional in support of financial advisors with their clients and prospects.

AgencyONE’s goal is to help raise awareness regarding the impending threat of estate confiscation. The new proposed estate tax law is an opportunity to encourage taxpayers to engage with their legal and financial advisors to begin planning estate succession. Helping your clients perpetuate their legacy of hard-earned wealth requires astute advice and planning.