Alcohol Consumption and Underwriting

April is National Alcohol Awareness Month and is meant to help increase knowledge about the use and abuse of alcohol in the United States. Alcoholism is one of our country’s chief public health problems and at AgencyONE, we regularly see cases that are impacted by the use of alcohol. Our underwriting ONE IDEA this month focuses on alcohol consumption and underwriting and specifically addresses underwriting “healthy” alcohol use versus alcohol misuse or abuse.

April is National Alcohol Awareness Month and is meant to help increase knowledge about the use and abuse of alcohol in the United States. Alcoholism is one of our country’s chief public health problems and at AgencyONE, we regularly see cases that are impacted by the use of alcohol. Our underwriting ONE IDEA this month focuses on alcohol consumption and underwriting and specifically addresses underwriting “healthy” alcohol use versus alcohol misuse or abuse.

Alcohol is GOOD for you!

Yes, we said that. Medical experts agree that moderate alcohol use can have some positive physical effects such as:

- raising your GOOD cholesterol (HDL) level

- lessening your risk of developing and dying from heart disease

- reducing your risk of stroke as a result of narrowed or blocked brain arteries

- lowering your risk of developing diabetes

Alcohol is BAD for you!

Yes, we said that too. Remember, ONE DRINK is good, and while TWO or MORE may “feel” better, any physical benefits may be negated or reversed with an increase in consumption beyond what is considered moderate – one drink or less per day for women and two or less per day for men. Overindulgence has been known to lead to problems. After all, alcohol is considered a poison given that it is metabolized into acetaldehyde, which is a toxic carcinogen.

Yes, we said that too. Remember, ONE DRINK is good, and while TWO or MORE may “feel” better, any physical benefits may be negated or reversed with an increase in consumption beyond what is considered moderate – one drink or less per day for women and two or less per day for men. Overindulgence has been known to lead to problems. After all, alcohol is considered a poison given that it is metabolized into acetaldehyde, which is a toxic carcinogen.

Alcohol Consumption & Life Insurance Underwriting

No one has a drinking problem, and everyone is a PREFERRED RISK—that seems to be the typical applicant for insurance that we see at AgencyONE. That is until we start examining medical records.

Alcohol is metabolized by the LIVER and has an impact on liver function. Liver function studies are a part of medical records and are used by underwriters to identify and measure possible alcohol abuse. Elevated liver function studies may be the first clue for an underwriter that an alcohol concern exists.

alcohol abuse. Elevated liver function studies may be the first clue for an underwriter that an alcohol concern exists.

While most attending physician blood panels will contain two liver function studies (SGOT and SGPT), the life insurance industry routinely performs additional liver function testing, specifically a Gamma-Glutamyl Transferase (GGTP) test. This particular liver enzyme is VERY sensitive but also NON-SPECIFIC. It is produced as a reaction to a chemical insult and is so sensitive that even chronic use of over-the-counter drugs that are metabolized by the liver, can result in a GGTP elevation. While VERY sensitive, this enzyme cannot identify the cause of the elevated blood level. The critical point is that UNDERWRITERS will consider an elevation in GGTP levels as ALCOHOL ABUSE until proven otherwise.

However, underwriters have additional blood tests that CAN point directly to ALCOHOL as the cause of an elevated GGTP or other liver functions. When positive, these special additional tests (CDT and HAA) indicate a very high level of alcohol insult within the past few weeks. While a person can stop drinking alcohol for 48 hours and eliminate any blood alcohol prior to an insurance exam, these additional tests are much more sensitive and have a much longer window of opportunity for underwriters to test for alcohol in the system. Your liver is like a pot of water on the stove…it can heat up in short order, but it stays HOT for a prolonged period of time.

However, underwriters have additional blood tests that CAN point directly to ALCOHOL as the cause of an elevated GGTP or other liver functions. When positive, these special additional tests (CDT and HAA) indicate a very high level of alcohol insult within the past few weeks. While a person can stop drinking alcohol for 48 hours and eliminate any blood alcohol prior to an insurance exam, these additional tests are much more sensitive and have a much longer window of opportunity for underwriters to test for alcohol in the system. Your liver is like a pot of water on the stove…it can heat up in short order, but it stays HOT for a prolonged period of time.

Some of our carrier partners require BLOOD ALCOHOL testing as part of the lab kit protocol. If you have a POSITIVE blood alcohol level during an insurance exam, you are generally DECLINED outright. However, a NEGATIVE Blood Alcohol does NOT necessarily put you in the clear. When underwriters suspect alcohol abuse, their concerns increase as they are pricing cases for potential early mortality.

Additional Underwriting Resources

The chronic use/abuse of alcohol can lead to the following:

- Bone marrow suppression—your CBC (Complete Blood Count) will be abnormal and may lead to anemia

- Increased risk of cancers—Esophageal, Mouth, Liver, Colon

- Increased risk of accidents—in the home and on the road

Did you know that after just 4 weeks of ZERO alcohol consumption, your liver stabilizes, your blood pressure comes down, your cholesterol level improves, and your risk of diabetes decreases? These are important facts to communicate to your clients when they are preparing to apply for life insurance coverage.

Alcohol Consumption Case Study

Ms. Lane is a 63-year-old non-smoking female in excellent health with no significant medical history. She has an optimal build, is up to date with all routine medical care, exercises five days per week, and takes just a low dose of Lisinopril for blood pressure control. Her advisor is expecting a PREFERRED NON-SMOKER rating and the case is directed to ONE carrier as a formal submission – Carrier X for $2,000,000 of Universal Life (UL) insurance.

Ms. Lane is a 63-year-old non-smoking female in excellent health with no significant medical history. She has an optimal build, is up to date with all routine medical care, exercises five days per week, and takes just a low dose of Lisinopril for blood pressure control. Her advisor is expecting a PREFERRED NON-SMOKER rating and the case is directed to ONE carrier as a formal submission – Carrier X for $2,000,000 of Universal Life (UL) insurance.

On the application, Ms. Lane answers the ALCOHOL use question saying she “drinks two glasses of wine a day.” ALERT: This would have been the OPTIMAL TIME to advise the client that the insurance exam DOES TEST liver functions and may include some other alcohol specific testing, so it is IMPERATIVE that your client prepare for the insurance exam. AgencyONE has an Exam Prep Video that provides valuable information about alcohol consumption, among other things. We recommend you get in the practice of sending our Exam Prep Video to all of your clients.

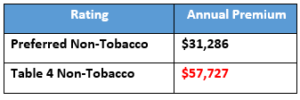

Ms. Lane’s APS’s are in, underwriting is tentatively approved and her case looks good for Preferred Non-Tobacco – subject to the exam, of course. To everyone’s surprise, the paramed exam results come back with an elevated GGTP liver function. This generates an automatic request for a CDT “Alcohol Marker” test that comes back POSITIVE! The agent’s PREFERRED RISK case suddenly becomes a DECLINE that AgencyONE negotiated to a Table 4 with Carrier X.

At Table 4 Non-Tobacco rates, the annual premium was now nearly DOUBLE the amount that Ms. Lane was prepared to pay. During discussions with her advisor and after the positive CDT came to light, Ms. Lane admitted that her drinking had increased during the pandemic. The results of her insurance exam were a wake-up call causing Ms. Lane to QUIT drinking alcohol completely. She agreed to retesting which now resulted in a NEGATIVE CDT alcohol marker. We submitted the case to a different carrier partner whose underwriter agreed Ms. Lane was, in fact, a PREFERRED mortality risk and issued her a policy with a PREFERRED rating!

A POSITIVE CDT marker usually only occurs with HEAVY drinking, more than 3 ounces of pure alcohol consistently for a period of time (a whole bottle of wine). Many carriers decline outright with a positive CDT and will postpone ANY consideration of life insurance protection for at least a year. Reevaluation of any substandard contract in your advisory portfolio SHOULD be reviewed on every policy anniversary as TIME IS NOT THE ENEMY on many of these cases. A Table 4 last year can become a PREFERRED case TODAY!!

Remember, your FIELD UNDERWRITING is the first line in helping your clients understand the underwriting process and also the insurance exam labs that will focus on alcohol use. AgencyONE’s underwriting skill, our staff’s medical expertise, and our carrier connections and trust were instrumental in bringing this underwriting hiccup to a very favorable conclusion.

Please contact AgencyONE’s Underwriting Department at 301.803.7500 for more information or to discuss a case.