Have the IRS Fund Your Family Legacy

For those of us who have been in the estate, retirement or financial planning profession for many years, we have all heard the sales approach of asking your clients “if you had the choice to disinherit either the IRS, your children, or charitable organizations, which ONE would you pick?”

If you have children (and actually like them), the choice is really between the IRS and charity, and most people would choose to disinherit the IRS. Regrettably, there are many people who do not understand that they have unintentionally named the Internal Revenue Service as a beneficiary of their IRA or other qualified plan assets, such as 401(k) accounts. They may as well have listed the IRS as an additional beneficiary on their IRA or 401(k) accounts, as I have done by way of example, per the Beneficiary Designation Form illustrated below:

This is a little bit “tongue in cheek”, but I hope you get where I am coming from.

The tax rules for non-spousal beneficiaries of qualified assets are complex, and decisions should not be made without proper guidance from a financial professional. However, too many people are proceeding WITHOUT obtaining this advice. With approximately $29 TRILLION in 401(k) and IRA assets held by Americans at the end of the first quarter of 2025 (according to the Investment Company Institute), the revenue opportunity for the IRS is staggering. Taxpayer ignorance will feed the coffers of the Treasury Department to pay for services to the American people.

In very general terms, non-spousal IRA/401(k) beneficiaries are required to deplete any inherited funds by no later than 10 years from the date of the inheritance and pay their fair share of income taxes on those funds. These beneficiaries can take the funds in a lump sum immediately, make distributions in installments over 10 years, or leave the money to grow and wait to take a lump sum distribution at the end of the 10 years. The penalties for not complying with these rules can be onerous. These are the complex and generalized distribution rules under the SECURE Act of 2019, with further guidance from the SECURE Act 2.0 passed in 2022. The bottom line is that the Treasury Department wants their pound of flesh, and they want it sooner rather than later, as your tax dollars pay for a plethora of things such as veterans’ benefits, education, scientific and medical research and development, housing & community and other critical services that the government provides. And they also pay for other things including military spending, interest payments on the $36TT National Debt, Social Security and Medicare.

So, do you want to be a voluntary or involuntary philanthropist? Because one way or the other, you will be contributing to the cost of services provided to the citizens of these United States of America.

But, you do have a choice! Instead of having your children pay taxes to Uncle Sam on the IRA and 401(k) assets that you (and your spouse) do not spend during your lifetime, you can redirect those funds to charitable organizations that provide similar services (education, scientific & medical research, health services, veterans organizations, etc.). Let’s face it, government spending has run amok, and taxpayers have zero control over how our government spends our financial contributions to the nation.

AND it gets better. Enter the Donor Advised Fund or DAF. A DAF is simply a charitable giving account that allows individuals to make contributions, receive immediate tax deductions, and recommend grants to charitable organizations over time. A DAF can be set up in the family’s name (The Garcia Family Charitable Fund, for example), be the beneficiary of any leftover qualified plan dollars, and make grants to charitable organizations over many years by your children, grandchildren and possibly generations beyond that. Any dollars directed to the DAF ARE NOT taxed to your children, hence disinheriting your least favorite uncle, Sam.

This is how you become a voluntary philanthropist and take control of how your unused retirement assets get redeployed. Of course, you can always spend every penny of your qualified accounts before you pass away and then your children will not have a tax problem.

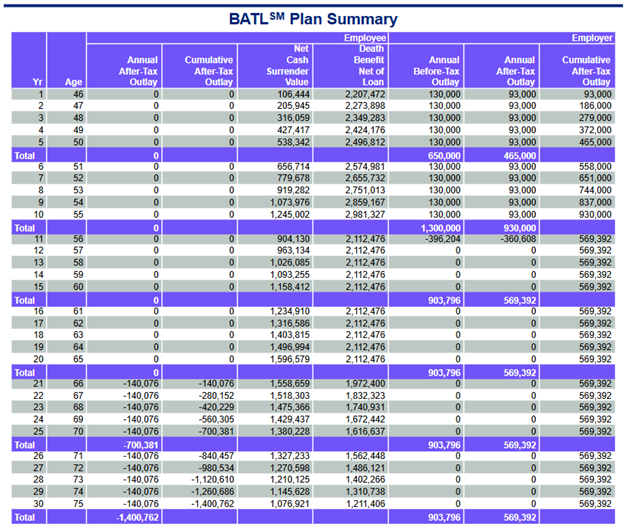

Let me show you how this works through a case that AgencyONE recently advised on.

Jane Smith (yes, of course I changed her name) is a 62-year-old woman whose husband John recently passed away. John had $3,000,000 of life insurance payable to Jane at the time of his death, which added to their investment portfolio, income tax-free. Jane was the named beneficiary of John’s $3,000,000 IRA account. As a spouse, Jane steps “into John’s shoes” as the IRA owner and now her two children are the non-spousal beneficiaries.

Additionally, Jane and John owned a home, which had been paid off, valued at approximately $1,000,000 and they also had a joint investment account of approximately $1,000,000. Jane will also receive her deceased husband’s Social Security Benefit of $3,000 per month. Jane’s lifestyle requires $150,000 after taxes on an annual basis, and she asked her financial planner if an additional $30,000 could be spent on travel to see her children and friends more frequently.

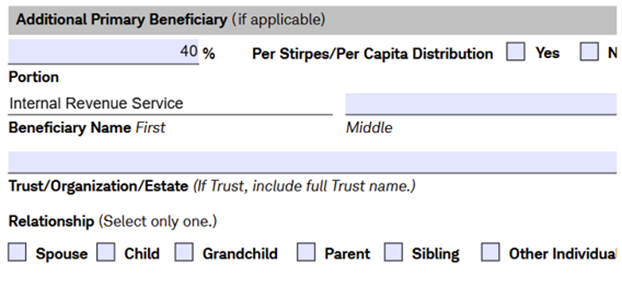

AgencyONE worked with Jane’s financial planner. We ran a variety of scenarios to make sure that we met her lifestyle goals, assuming a 3% inflation rate. The typical plan that I see looks like the chart below, where the client spends their Social Security (orange) and non-qualified assets (red) FIRST, leaving the IRA dollars to be drawn down using Required Minimum Distributions (purple).

With this scenario, Jane’s income and lifestyle goals are adequately met in alomst all Montecarlo simulations for returns. However, there is one problem…

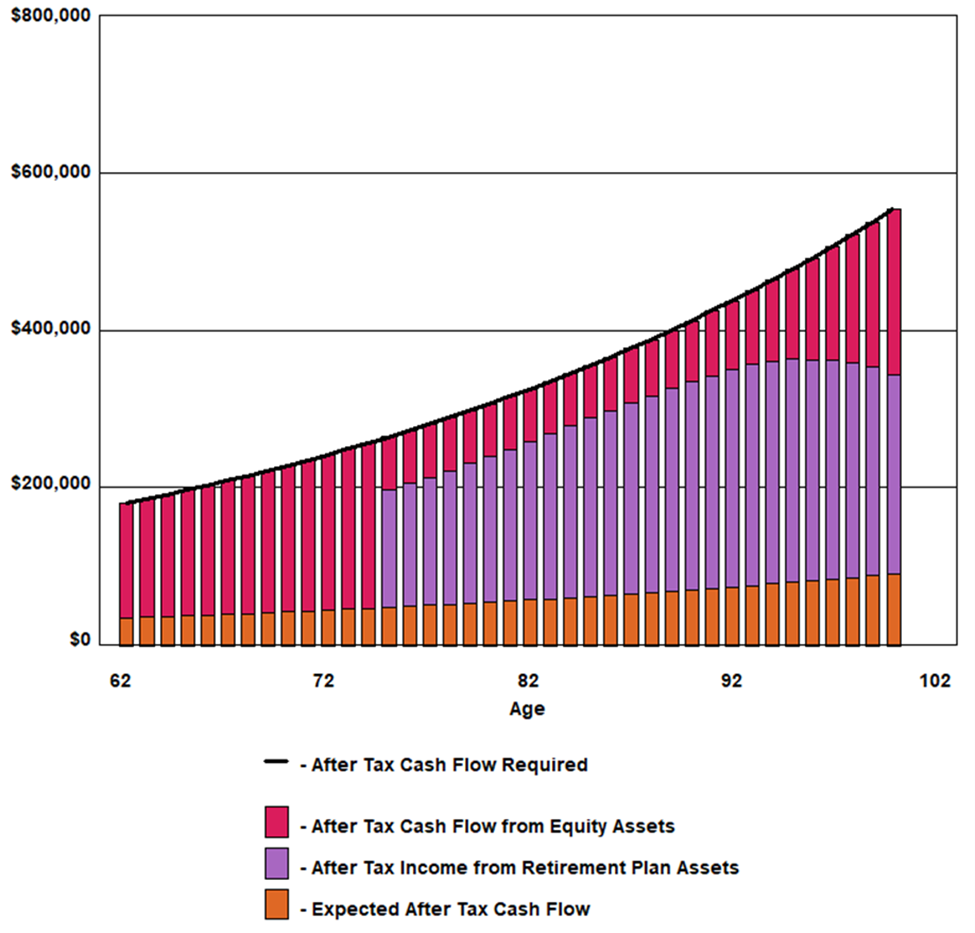

Assuming Jane passes away at age 85, her children would receive approximately a $12.59MM inheritance but would owe approximately $1.9MM in taxes on Jane’s remaining IRA balance.

This is because, as stated previously, taxes must be paid on any balances in qualified accounts that pass to a non-spousal beneficiary – and they are taxed as ordinary income.

These funds will go to the US Treasury Department to be used to pay for all the budget items mentioned above.

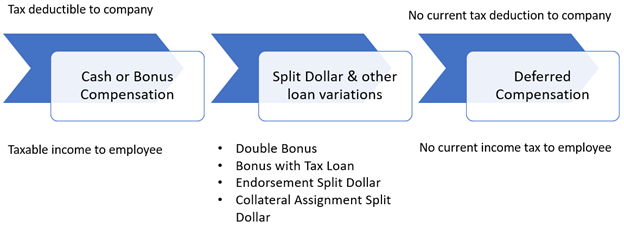

Voluntary Philanthropy

When I talk about Voluntary Philanthropy, I do not mean that clients should necessarily be charitably inclined in any meaningful way. Clients simply need to understand that they are already contributing to “charitable causes” through the taxes they pay, but they have no control over where their money goes or how it is used. They need to “want to” disinherit the IRS by CHOOSING to make charitable donations versus PAYING income taxes. There is a reason that charitable donations are a deductible expense, if you itemize your deductions on Form 1040 – it is a government incentive. So how do we do that?

What if we could deliver results like this?

Here are the steps that Jane can use to accomplish this result:

- Jane sets up a Donor Advised Fund – the Smith Family Charitable Fund – and deposits some amount into it as seed money. The donation could be low basis, highly appreciated securities, which means she will not pay capital gains taxes to make the donation.

- Jane applies for life insurance in the amount (in this case) of $5,000,000.

- Once the life insurance is approved, Jane takes a distribution from her IRA to cover the premium payment and the taxes due on the distribution.

- Jane names her children as the beneficiaries of her life insurance.

- Jane designates the primary beneficiary of the IRA as the Smith Family Charitable Fund (her family’s Donor Advised Fund).

- Upon Jane’s death, any unused IRA balance, in this case $3.2MM, goes to the DAF and her children get the $5MM of life insurance income tax-free, along with any other non-qualified assets, which will enjoy a step up in basis for capital gains tax purposes.

The Montecarlo simulations for retirement income and lifestyle purposes continue to meet Jane’s objectives, assuming the same 3% inflation used in the initial scenario. Jane’s children’s inheritance drops from $12.59MM to $12MM, so they have given up $600,000. However, they will now have $3.2MM in a Donor Advised Fund that they can use over their lifetime to give to any qualified charity of their choice. In fact, this DAF, assuming a 5% withdrawal rate, can give Jane’s children, and possibly future generations, the ability to make charitable donations of over $150,000 per year to their favorite charities in the name of the Smith Family.

AgencyONE constructed this analysis using both eMoney and Insmark’s Wealthy and Wise software in collaboration with the CFP Professional advising the client. We have also built a PowerPoint presentation that would allow us to provide a client-ready, customized presentation, subject to your firm’s compliance review, along with the full Insmark Wealthy & Wise analytics report.

If you are an advisor and have clients with IRA or 401(k) balances over $250,000, ask these clients or yourself, as their advisor, the following questions:

- Do they have other lifestyle assets for retirement?

- Will they consume the entire qualified plan balance during their lifetime, or will they only draw down minimum distributions as required by the IRS (age 73 or 75)?

To receive the PowerPoint presentation and the Insmark report, please fill out the form linked here, and we’ll email them to you.

Contact AgencyONE at 301.803.7500 if you would like to collaborate on a similar analysis or to discuss a case.