How Aviation and other Avocations Affect Life Underwriting

Medical Impairments are not the only circumstances that threaten mortality and your client’s underwriting success. Hobbies and occupations offer their own type of risk (just ask Jeff Bezos and Richard Branson). With the advent of PRIVATE space travel, we are sure the Life Insurance companies are already considering the risk and how to charge EXTRA for it! In this ONE Idea we will discuss how aviation and other avocations affect underwriting for life insurance.

AVIATION & UNDERWRITING

Licensed Commercial Airline Pilots employed by registered airlines are subjected to intense training and certification. Assuming they are transporting passengers or freight, these pilots carry the SAME mortality risk as a non-pilot, meaning they would be underwritten at the top Preferred class in which they qualify. Some licensed pilots also fly PRIVATE, which CHANGES the risk perception for insurance companies.

the SAME mortality risk as a non-pilot, meaning they would be underwritten at the top Preferred class in which they qualify. Some licensed pilots also fly PRIVATE, which CHANGES the risk perception for insurance companies.

Civil Aviation (private pilots) present different risks to the life insurance underwriter. There are multiple levels of licensure: Student Pilot Certificate, Private Pilot Certificate, and Instrument Flight Rating (IFR).

The following factors can affect the underwriting rate class:

- Type of license earned

- Type of aircraft flown

- Number of solo flying hours and hours flown annually

A student pilot with little flight experience is considered a risk because they have a higher probability of accident (and death) than an experienced pilot. And newly licensed pilots with less than 100 hours of solo time also pose a greater risk because they are not yet considered experienced – 100 hours of solo flight time logged is considered experienced.

Underwriters will further dissect these risks by assessing the individual’s PROFICIENCY and the type of aircraft they fly. Is the pilot flying ENOUGH each year (about 25 hours) to maintain expertise but not more than 200 hours, which places the pilot in a higher risk class statistically for an accident?

VFR versus IFR

VISUAL FLIGHT RULES (VFR) mean that the aircraft is intended to operate in Visual Meteorological Conditions (VMC), i.e., clear skies, nice weather, ideal visibility. Fog, heavy precipitation, low visibility, and otherwise adverse weather conditions are supposed to be avoided (which is why these “rules” were a big topic of discussion surrounding Kobe Bryant’s death, as the helicopter was flying under MODIFIED VFR rules).

VISUAL FLIGHT RULES (VFR) mean that the aircraft is intended to operate in Visual Meteorological Conditions (VMC), i.e., clear skies, nice weather, ideal visibility. Fog, heavy precipitation, low visibility, and otherwise adverse weather conditions are supposed to be avoided (which is why these “rules” were a big topic of discussion surrounding Kobe Bryant’s death, as the helicopter was flying under MODIFIED VFR rules).

INSTRUMENT FLIGHT RULES (IFR) mean the flight/aircraft may operate under Instrument Meteorological Conditions (IMC), i.e., cloudy, or adverse weather conditions. A pilot who has earned his or her Instrument Rating (IR) has gone through intensive training focused on flying solely by using the airplane instruments – technically, the pilot does not even need to look out the window for visual guidance! Having this rating generally makes for a safer pilot, one equipped to manage and avoid changes in environmental conditions during flight. A pilot who possesses this rating is a better life insurance risk!

Each carrier has its own criteria for determining the “aviation risk” or extra mortality charges that may come in the form of a Flat Extra premium or a downgrade in underwriting class (Standard versus Preferred) or a combination of both.

If you have clients that do not want to pay for Aviation Risk in their life insurance policies, many of our carrier partners offer aviation exclusion riders as an option.

The best way to begin a case with a client who is a pilot is to have them complete our AgencyONE Aviation Questionnaire. With this important data, AgencyONE will find you and your client the most competitive rate class.

AVOCATION & UNDERWRITING

You may also have clients who love adventure. Hobbies like rock climbing, mountain climbing, scuba diving, drag racing, and heli-skiing are great fun, but the enjoyment they offer can add quite a bit of cost to your client’s life insurance premiums. As in medical underwriting, carriers can view the same information very differently. If your client answers “yes” to any of these questions, it is very important to request and complete the specific avocation questionnaire(s) that apply. To find these questionnaires, log into the AgencyONE website to access your Advisor Dashboard and navigate to the Underwriting drop down tab. AgencyONE can discuss exclusion options, if available, or provide details to our carriers so we can negotiate with them to obtain the most favorable rates available for your clients.

a bit of cost to your client’s life insurance premiums. As in medical underwriting, carriers can view the same information very differently. If your client answers “yes” to any of these questions, it is very important to request and complete the specific avocation questionnaire(s) that apply. To find these questionnaires, log into the AgencyONE website to access your Advisor Dashboard and navigate to the Underwriting drop down tab. AgencyONE can discuss exclusion options, if available, or provide details to our carriers so we can negotiate with them to obtain the most favorable rates available for your clients.

UNDERWRITING AVOCATION – CASE STUDY

Harry Daredevil is a 35-year-old executive with no significant medical history. He has a student pilot license and has logged only 12 hours of flight time over the last year. He intends to fly an additional 30 hours over the next year and complete the requirements to get a Private Pilot certificate. Mr. Daredevil is applying for $10M of TERM coverage and does not want to exclude aviation from the risk.

Harry Daredevil is a 35-year-old executive with no significant medical history. He has a student pilot license and has logged only 12 hours of flight time over the last year. He intends to fly an additional 30 hours over the next year and complete the requirements to get a Private Pilot certificate. Mr. Daredevil is applying for $10M of TERM coverage and does not want to exclude aviation from the risk.

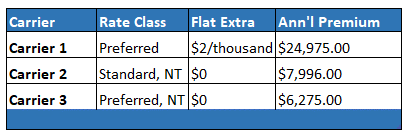

AgencyONE sent the pertinent details to several of our carrier partners. Some carriers will maintain a standard rate class regardless of medical history while others may allow a preferred offer with a Flat Extra rating. EIGHT – but not all – carriers wanted to charge between a $2 and $3 Flat Extra premium, per thousand dollars, for the entire duration of the TERM coverage!

Take a look at the premium difference between carriers:

Each avocation risk is unique and requires special consideration and handling. Regardless of your client’s special avocation, AgencyONE’s goal is always the same – to obtain for your client the lowest possible rating class BOTH medically AND for the avocation risk. Give AgencyONE a call the next time you “gotta guy” who pilots a plane, rock or mountain climbs, scuba dives, or has dreams of flying to the moon! AgencyONE can get them underwritten for you.