Life Insurance Underwriting During Covid-19

Six months ago, our country was forced into a swift, extraordinary change as the threat of COVID-19 was realized. Uncertainty lead to quarantine, lock downs, virtual everything and life as we knew it seemed to stop. Adapting to the changes in life insurance underwriting in a Covid-19 environment became a reality that none of us could have imagined.

Six months ago, our country was forced into a swift, extraordinary change as the threat of COVID-19 was realized. Uncertainty lead to quarantine, lock downs, virtual everything and life as we knew it seemed to stop. Adapting to the changes in life insurance underwriting in a Covid-19 environment became a reality that none of us could have imagined.

In a matter of two weeks, just about EVERYTHING in life insurance underwriting was turned on its proverbial head. The carrier guidelines, niches, and sweet spots that we had mastered suddenly changed. The knowledge and experience you rely on from AgencyONE for your impaired-risk cases was steadily curtailed as a multitude of underwriting restrictions suddenly limited the available options.

Obtaining exam requirements was another hurdle we ALL had to overcome. YOU encountered and overcame many obstacles while being forced to work with your clients virtually and navigate numerous technology platforms to communicate, access medical information, underwrite without insurance exams, and e-deliver policies. Adapting to the changes in life insurance underwriting in a Covid-19 environment has required a tremendous shift in our habits as professionals and the industry at large.

Needless to say, we all had to pivot quickly. Expanded communication and educational efforts, coupled with solid teamwork throughout these unique circumstances has helped us maintain our success, and we applaud the flexibility and determination of our AgencyONE 100 Advisors.

So Where Are We Now In Adapting To The Changes In Life Insurance Underwriting In A Covid-19 Environment?

Last week, AgencyONE had a webinar for our AgencyONE 100 Advisors entitled What is Happening in Underwriting Now?. This week’s ONE Idea will:

- revisit a few highlights from that presentation;

- demonstrate HOW underwriting impaired risk cases has changed; and

- discuss your role in ensuring the successful placement of your cases.

What is getting better?

Some of the first COVID guidelines to ease have been with the older-age restrictions. We have at least six carriers now considering applicants over age 80 and fourteen carriers looking at applicants over age 70. Most carriers require that these individuals be pure, standard risks, but there are some exceptions.

Planned foreign travel is NO LONGER an immediate postpone at a handful of carriers. The country and location of travel will largely dictate insurability, but we have options.

Foreign National business is also now being considered at several carriers. Consideration of insurability largely depends on the applicant’s country of origin. Some carriers are lifting quarantine and COVID testing requirements for these individuals and we even have one carrier that will allow for (international) electronic delivery of policies.

Challenges persist

Many carriers applied restrictions to cases assessed with table ratings or pre-existing medical conditions that had the potential to become significantly worse in the event of a COVID infection. These medical conditions include diabetes, obesity, cancer histories, clients on immunosuppressants and more. We can no longer expect that a Type 2 diabetic with well-controlled A1C’s, no complications, and well-managed hypertension will be a “Standard” risk. Some cancer cases that would have been deemed Standard “by-the-book” pre-COVID are now “COVID postpones”. We are now dealing with a “new normal”.

However, a very small number of carriers did NOT place blanket restrictions on age or medical underwriting in any way. (We are looking at YOU Nationwide and Security Mutual Life of New York). These carriers maintained their commitment to look at each case and consider them on their own, individual merits and for that, we THANK YOU!

Underwriting Technology To The Rescue

AgencyONE is contracted with more than 25 carriers and keeping their guidelines and niches straight is challenging on a good day. The ever-changing “COVID” restrictions added another layer of complexity. QUOTE SHOP is our quick-quote underwriting platform that allows us to survey more than 20 carriers for offer competitiveness. PRE-COVID, we primarily used this resource for avocations, adverse driving histories, unique medical diagnoses, substance histories, and/or cancer pathology reports. During COVID, we are taking advantage of this platform to “pre-assess” as many impaired-risk cases as possible.

Quick-Quote success is only achievable when we have the necessary DETAILS to ensure the feedback is reliable. This begins with thorough FIELD UNDERWRITING and capturing your clients’ ENTIRE medical, social, and family histories. Once pertinent medical information is received, we create detailed, comprehensive summaries and get feedback from 20 plus carriers within 48 hours. This platform has been a GOD-send in helping us narrow down carrier pricing and direction under the current multitude of underwriting restrictions.

Underwriting Case Study

Let’s have a look at a before and after COVID case:

A 76-year-old gentleman needs $1MM of UL coverage. He has a history of intermittent atrial fibrillation without any recent episodes. He is on Eliquis (blood thinner) for precaution and takes a medication for well-controlled cholesterol.

By the book: This diagnosis carries a TWO TABLE rating, with the possibility of crediting for stable use of anticoagulants (blood thinners), normal echocardiogram and/or 5 years of overall cardiovascular stability. Knowing he has been stable and on blood thinners, AgencyONE could easily hedge that a STANDARD offer would be a reasonable rate class to request…PRE-COVID.

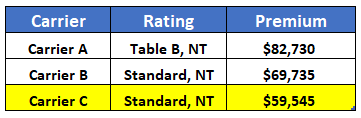

We ran numbers and approached the top TEN carriers through Quote Shop. SEVEN of the TEN carriers saw this case as a COVID Postpone.

After informal review, we received a Table 2 from Carrier A and negotiated STANDARD offers from Carriers B and C.

The bottom line is that AgencyONE continues to place your business. It may take a few extra steps or telephone calls, but we are doing everything possible to get your impaired risk cases PLACED! It takes TEAMWORK, so please get us ALL the detailed information necessary UP FRONT to set your cases up for success.

The AgencyONE Underwriting Department is working diligently to stay abreast of ALL the carrier changes so that we can provide you and your clients with the best possible offers available. Don’t forget to take advantage of the tools available on www.agencyone.net on your personal dashboard under the “underwriting tab”.