Osteoporosis – Can I Still Get a Preferred Life Insurance Offer?

We’ve all heard about OSTEOPOROSIS but WHAT EXACTLY does this condition mean to underwriting life insurance protection or long-term care contracts? This ONE Idea will discuss bone health and why it is so important to mortality and morbidity when considering the purchase of insurance.

Aging & Bone Health

If you are over age 30, you are unfortunately on the downslope of bone strength. Whether male or female, your bones begin to remodel or change after age 30 with genetics, nutrition and exercise impacting the rate of decline in bone mass and bone strength. After menopause, women can have a marked decrease in bone mass and increase in demineralization. The statistics tell us that 1 in 3 women over the age of 50 will experience an Osteoporotic fracture in their lifetime. It’s not much better in men – 1 in 5.

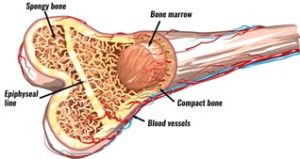

Structure of Your Bones

Your bones are solid on the outside but have an interior that looks like rolled-up cheese cloth or sponge. Bone marrow occupies the center and is instrumental in manufacturing new blood cells. The bone MATRIX is a combination of spongy bone, compact bone, arteries/veins, and a protective sheath that contains a nerve matrix that generates pain when you injure or break a bone. Your bones are more than just a structural component of your body…. they are living things. Bone material is manufactured, reabsorbed, and manufactured again by your body – a process that becomes LESS efficient as we get older.

What is Osteoporosis

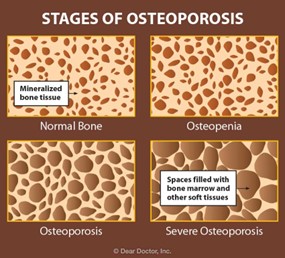

Osteoporosis is defined as the metabolic bone disorder that results in the reduction of bone material or bone MASS in the microscopic structure of the bone. It leads to microscopic fractures in the bone matrix that weakens the overall structure. Less mass means less strength. Less strength means the bone is more prone to fracture. AgencyONE’s underwriting team often sees bone studies on older clients that show fractures in the vertebrae of the back as bone strength decreases. Additionally, as we age our bones demineralize and we actually get SHORTER.

How to Diagnose Osteoporosis

The standard test for diagnosing Osteoporosis is the DEXA scan (Double-Energy X-ray) which generates a SCORE. The underwriting of both LIFE and LONG-TERM CARE insurance are DIRECTLY impacted by your client’s DEXA score. The LOWER the DEXA score, the worse the condition. A score of -1 (minus one) is the lower side of NORMAL; a higher score like “0” or +1 would be excellent. A DEXA score between -1 and -2.4 would indicate Osteopenia (the precursor to Osteoporosis) or LOW BONE MASS. Osteoporosis is more severe and comes with a DEXA bone mass score -2.5 or lower.

Bone Health & Underwriting

DEXA scores play a MAJOR part in underwriting both life insurance and LTC contracts. Life insurance companies will evaluate your client’s ability to perform the SIX ACTIVITIES OF DAILY LIVING when assessing your client’s risk. Is your client having difficulties NOW because of deteriorating bone health? Is your client using a cane or walker to get around? Has your client had a fracture or fall within the past 5 years? These kind of MORBIDITY issues can certainly play a role in MORTALITY. The worse your client’s bone density the more likely your client could sustain an injury from a trip or fall.

Aging & Bone Health – Nutrition & Exercise

Good Nutrition and regular physical exercise have proven to defer the negative effects of aging on the bones. Getting the RIGHT amount of Calcium and adequate Protein in your diet is an important start along with a taking a Vitamin D supplement which helps the body absorb Calcium more efficiently. Advise your clients to speak with their physician about nutritional support and exercise. Strength exercises are important but RESISTANCE exercises such as swimming, exercising with elastic bands, walking, playing tennis, hiking, and dancing may be even better. Strength exercises build muscle which assists with balance, movement, and stability and can help prevent a fall that could possibly result in a fracture, a break, or worse!

AgencyONE’s Informal Inquiry contains a LIFESTYLE information page that allows for you and your client to ADD this vital information for underwriting review. LIFESTYLE CREDITS for underwriting purposes can be gained with calcium supplements, vitamins, regular exercise regimens, good nutrition, and social interaction. This is VERY IMPORTANT INFORMATION to provide the life insurance underwriter in your cover letter and applications.

Underwriting Bone Health – Case Study

Ms. Summers is a 58-year-old healthy woman who is seeking $3,000,000 of permanent life insurance coverage with a long-term care rider. She would consider an underwritten chronic illness rider as a back-up option but securing a long-term care rider is the ultimate goal for the client. Ms. Summers is a very healthy and active individual with minimal medical history, but she was diagnosed with Osteoporosis in 2019 through bone density scanning (DEXA). At the time of diagnosis, Ms. Summers began a prescribed Fosamax treatment and has remained on the medication without issue. Since her diagnosis and start of medical treatment, Ms. Summers has also increased her exercise. She engages in light aerobic workouts five times per week and strength training four times per week. A repeat DEXA in 2021 revealed that her bone density was stable from prior imaging with her lowest T-score at -3.1.

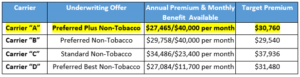

AgencyONE approached four carriers informally for consideration of Ms. Summers’ case. Carriers A, B, and C offer long-term care riders, while Carrier D only has the option of an underwritten chronic illness rider. Given Ms. Summers’ overall favorable health profile, including regular physician follow-up, well managed Fosamax treatment, and routine exercise, AgencyONE’s underwriting team was able to successfully negotiate offers (including their respective riders) from ALL four carriers. Carrier D’s annual premium was the lowest, but with the chronic illness rider the monthly benefit was capped at only $11,700 a month! Carrier A was far and above the winner as they offered an LTC rider with the highest per month benefit for the lowest annual premium. Ms. Summers submitted a formal application to Carrier A and secured both the life insurance coverage and LTC benefits needed to protect her family and provide long-term care benefits should she need them in the future.

If you have older clients with waning bone health, AgencyONE will help get the coverage they need with the appropriate carrier at the desired premium.

Please contact AgencyONE’s Underwriting Department at 301-803-7504 for more information or

to discuss a case.