Underwriting and Marijuana Use – “But I Have a Prescription!”

Many people are confused about how marijuana use is treated during medical underwriting for life insurance. They believe that having a medical marijuana prescription will make the process easier… “no problem, I have a prescription” …. well, not necessarily. This week’s ONE Idea will deal with some common misconceptions about underwriting and marijuana use and discuss how they should be managed to help the underwriting process for insurance.

Many people are confused about how marijuana use is treated during medical underwriting for life insurance. They believe that having a medical marijuana prescription will make the process easier… “no problem, I have a prescription” …. well, not necessarily. This week’s ONE Idea will deal with some common misconceptions about underwriting and marijuana use and discuss how they should be managed to help the underwriting process for insurance.

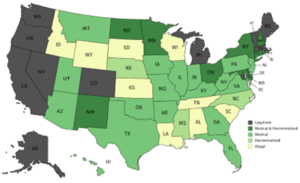

Marijuana is legal now. True, but also FALSE

Marijuana is fully legal in certain states for recreational use. In other states, you must have a PRESCRIPTION to access “dispensaries.” In other states, marijuana is still considered illegal and a crime to possess. This set of conflicting standards across different states is further complicated by the FEDERAL government’s consideration of marijuana which is still listed as a Schedule I substance …and a crime. However, the federal government’s enforcement (Justice Department) of this has been put on LOW priority in most areas except BANKING.

Banks operate under FEDERAL regulation and jurisdiction. Even if marijuana use has been legalized by a particular state, the MONIES earned  by “local” (state) marijuana industries are STILL considered ILLEGAL ACTIVITIES at the Federal level! Depositing monies into the Federal Banking systems that have been generated from “illegal” activities is simply MONEY LAUNDERING from the Fed perspective. A quote from a California Assemblyman in an article entitled “Banking and Cannabis: Yearning to be Buds” on the NCSL (National Conference of State Legislatures) website says it all: “Having an entire industry operating with limited access to banking services is a serious public safety threat and makes commercial cannabis businesses a target for crime, putting the safety of employees and customers at risk.” Life insurance companies operate within the rules and regulations of the FEDERAL banking system and cannot/should not accept monies from known “criminal” sources.

by “local” (state) marijuana industries are STILL considered ILLEGAL ACTIVITIES at the Federal level! Depositing monies into the Federal Banking systems that have been generated from “illegal” activities is simply MONEY LAUNDERING from the Fed perspective. A quote from a California Assemblyman in an article entitled “Banking and Cannabis: Yearning to be Buds” on the NCSL (National Conference of State Legislatures) website says it all: “Having an entire industry operating with limited access to banking services is a serious public safety threat and makes commercial cannabis businesses a target for crime, putting the safety of employees and customers at risk.” Life insurance companies operate within the rules and regulations of the FEDERAL banking system and cannot/should not accept monies from known “criminal” sources.

Having a PRESCRIPTION for Marijuana makes it OK. True, but also FALSE

Underwriting life insurance protection with admitted marijuana usage has loosened considerably over the past few years. However, by admitting to PRESCRIPTION usage of marijuana, you are  also admitting to a TREATED MEDICAL PROBLEM. Think about it. Most prescription marijuana cards have been obtained by phone or internet interviews without an exam AND include the admission of a medical issue like anxiety, sleep disorder, back pain, neck pain, etc. It is a farce in most cases, but the admission of prescription marijuana use is also an ADMISSION of a MEDICAL PROBLEM and therefore an underwriting concern. Admitting “Back Pain” or “Anxiety” for receipt of the marijuana card raises the underwriting concern for Long Term Care contracts as well as Life Insurance applications.

also admitting to a TREATED MEDICAL PROBLEM. Think about it. Most prescription marijuana cards have been obtained by phone or internet interviews without an exam AND include the admission of a medical issue like anxiety, sleep disorder, back pain, neck pain, etc. It is a farce in most cases, but the admission of prescription marijuana use is also an ADMISSION of a MEDICAL PROBLEM and therefore an underwriting concern. Admitting “Back Pain” or “Anxiety” for receipt of the marijuana card raises the underwriting concern for Long Term Care contracts as well as Life Insurance applications.

If your client has a legitimate medical issue, then it should be admitted on the life insurance application AND the underwriters will need the medical records  or statement from the “prescribing” physician. However, the majority of these so-called PRESCRIPTION cards are NOT associated with legitimate medical issues. Clients should always tell the truth on a life insurance application and admit “RECREATIONAL” use of marijuana if this is in fact the case. Having a prescription card may help your client obtain the recreational marijuana he/she wants, but it does NOT help the life insurance underwriting process. How OFTEN your client uses marijuana is the underwriting issue, NOT whether he or she has a prescription. So, if your client wants to use marijuana and thinks that having a prescription card will make the use of it “legitimate,” remember it may complicate things in the eyes of the life insurance underwriter, potentially extend the underwriting process and delay getting your client’s coverage in place.

or statement from the “prescribing” physician. However, the majority of these so-called PRESCRIPTION cards are NOT associated with legitimate medical issues. Clients should always tell the truth on a life insurance application and admit “RECREATIONAL” use of marijuana if this is in fact the case. Having a prescription card may help your client obtain the recreational marijuana he/she wants, but it does NOT help the life insurance underwriting process. How OFTEN your client uses marijuana is the underwriting issue, NOT whether he or she has a prescription. So, if your client wants to use marijuana and thinks that having a prescription card will make the use of it “legitimate,” remember it may complicate things in the eyes of the life insurance underwriter, potentially extend the underwriting process and delay getting your client’s coverage in place.

Underwriting and Marijuana Use: Case Study

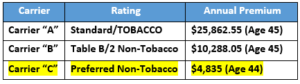

Ms. Mary Jane Smith is a 44-year-old non-smoking woman (age nearest 45) with a history of mild anxiety and insomnia. She wants to secure $5,000,000 of 20-year term life insurance coverage. Mary Jane was treated for anxiety with daily Lexapro but found the side effects to be more troublesome than the anxiety itself. She researched treatment alternatives and decided to try medicinal marijuana through a certified medical cannabis provider. The medical marijuana prescription in this case allowed Mary Jane to discontinue her anxiety medication, which in AgencyONE’s opinion, made her a BETTER RISK. Mary Jane now successfully manages her mild anxiety symptoms and insomnia by vaping marijuana four to five times each week. She discontinued her Lexapro use and attends individual therapy sessions on a monthly basis.

Mary Jane’s case was targeted to three of AgencyONE’s carrier partners for consideration through a quick quote summary. Carrier A saw her as a Standard risk but would have to assess smoker rates. Carrier B was able to offer non-tobacco rates but would not consider an offer better than Table 2. Carrier C (a current age carrier) quoted Standard Non-Tobacco rates, and a formal application was submitted. Once all formal application requirements were received by Carrier C, the AgencyONE Underwriting Team successfully negotiated a Preferred Non-Tobacco underwriting class for Ms. Smith!

Recreational use of marijuana no longer carries the stigma of “illegal” activity, so more people are admitting to its use on life insurance applications. Several carriers will still consider marijuana use as a SMOKER rate class, while others will consider it as PREFERRED NON-SMOKER, potentially even with admitted use of multiple times per week. There is a wide swing in the underwriting perceptions among carriers and how they assess these admitted uses. Please call AgencyONE to discuss your policy needs and your client’s admitted usage and we will discuss your carrier and product options.

Contact the AgencyONE Underwriting Department at 301.803.7500 for more information or to discuss a case.

Check out the corresponding video for this post HERE!