2020, Interest Rates, COVID & the Life Insurance Industry

The most meaningful impact of 2020 on the insurance industry was, very likely, the dramatic drop of interest rates. They have had a much greater effect than most people imagine. The bell weather indicator for interest rates in the insurance industry is the 10-year Treasury, as it constitutes a large portion of an insurance company’s portfolio. In 2018 yields were already low (sub-3%) but rising slowly, giving some insurance company executives a slightly more optimistic view on the financial pressure they had been experiencing. On November 8th, 2018, the 10-year rate peaked at 3.24%, then began to drop again …. and then COVID hit. Between January 1, 2020 and April 21, 2020 the yield plummeted from 1.92% to .58% – a 70% drop. As I write this, the rate is 1.10%.

When the yield on new money investments (premiums coming into an insurance company) drops 70% and as older bonds mature and you must reinvest the proceeds at .58% – that hurts! Why? Because this reinvestment begins to bring down your overall portfolio yield spread (the money the insurance company earns on a portfolio versus the money they credit on interest bearing products). This spread accounts for a fair portion of the profits of an insurance company.

Life Insurance Operational Challenges

2020 was a year of significant changes for insurance companies and most were as a result of the low interest rate environment. Did you wonder why so many senior people at your favorite insurance company retired last year or were laid off? Did you wonder why service levels at the insurance companies, despite heroic efforts and hard work, was terrible? Did you wonder why dividends dropped almost across the board on Whole Life insurance? Did you wonder why insurance companies did not want to take a check from that wealthy client of yours for $1,000,000? Did you wonder why products were pulled off the market or got more expensive? Did you wonder why underwriting decisions tightened? Did you wonder why insurance companies were pushing their Variable Life portfolios over their fixed product lines? There is one fundamental answer to all these questions – persistent low interest rates.

To compound these problems, some companies saw increases in business, as measured by application counts, in the high double digits. The carriers were understaffed, over-committed and operating on smaller margins. Meanwhile, most companies were rolling out not fully tested underwriting technology to handle this increased application count with mixed results. It sounds like a terrible situation – and it was.

And let us not forget the uncertainty that was prevalent around the election results impacting the very high estate and gift tax exemptions. If you were in the ultra-high net worth market, taxpayers, on the advice of their very smart lawyers, were moving large amounts of money into trusts and buying (or financing) life insurance. Did I mention that insurance companies did not really want big premiums?

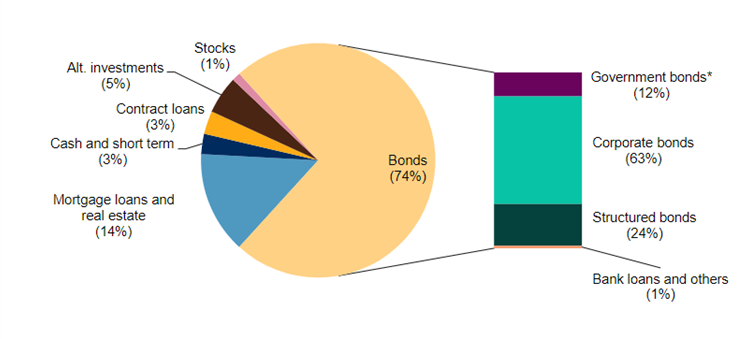

With all of that said, the life insurance industry has weathered many storms and is remarkably resilient and frankly, very integral to the overall wellbeing of the U.S. economy. S&P Global reported, in an article on September 16th, 2020, that at the end of 2019 the life insurance industry held $4.5 trillion in portfolio values with over 70%, or $3.1 trillion, in fixed-income securities. They will come out of this generally unscathed, but it will be a long hard road.

2021 & Insurance Industry Expectations

So, welcome 2021. What headwinds and opportunities do we see for 2021 after what could be called a disastrous year for the industry?

I am a “glass half full” kind of guy and I see a ton of upside in our industry for years to come and there are certainly things that will emerge in 2021 despite a continuing difficult situation with COVID, interest rates, and uncertainty around the economic and regulatory environment.

What to watch for in 2021:

- Product pricing, changes and introductions – I listened to the Finseca (the merger of AALU and GAMA) webcast on January 13th with Bobby Samuelson and he said one thing that really struck me … it was something along the lines of “if you thought product changes were crazy in 2020, just wait, it will be even crazier this year”.

- We have already seen some product discontinuance announcements in terms of Guaranteed Single Life and 2nd to Die Universal Life from some major carriers. The price of long dated guarantees (age 100+) is going to continue to get more expensive in the Universal Life market if they are even available by the end of the year.

- Bobby also discussed the recent changes in IRC Code Section 7702 which deals with the Guideline Premium Test (GPT), the Cash Value Accumulation Test (CVAT) that came out of the 1984 Tax Act (DEFRA) and consequently the Modified Endowment Contract (MEC) Test, that came of the 1987 Tax Act (TAMRA). While this will have an impact particularly on Whole Life, it will also increase the MEC limits for Universal Life (Fixed, Index and Variable) allowing clients to put more money into these contracts per dollar of face amount. This is a complex area and worthy of a ONEIdea and further discussion as carriers discontinue products and introduce new ones throughout the year.

- No-Loan or Low Load life insurance for distribution in the wealth management space as a tax deferred accumulation strategy will begin to emerge. I have been privy to and involved with some development efforts from a variety of companies already with plans to launch these products in 2021.

- Changes in Income, Gift and Estate Tax Rates – The Biden administration’s view on taxes will likely create higher income taxes (likely for higher income earners) and a change in the estate and gift tax regimes (likely lower exemptions and the possibility of changes in the step up in basis). These will create opportunities for financial professionals to discuss planning opportunities using several different tools/strategies:

- Irrevocable Life Insurance Trusts may become a tool that more of the population may need if and when the estate tax exemption is reduced.

- The low interest rate environment will continue to be very attractive for

- Grantor Retained Annuity Trusts

- Intra-family loans or asset sales in exchange for notes

- With higher income taxes, tax deferred accumulation using life insurance will be more attractive as Roth IRAs may not generally be available to those taxpayers impacted by the higher rates.

- Technology – Underwriting technology will continue to develop and grow. The insurance industry had to accelerate years of R&D in technology advances to facilitate underwriting during COVID for contactless and “no fluids” underwriting. Algorithmic underwriting (with little or no human intervention) will continue to play a huge role in the smaller transactional business while electronic health records (EHRs) and other ways to collect needed underwriting data will rule the day for larger risks. Full underwriting will continue to occur, just in a non-traditional way.

- Continued merger and acquisition activity in life distribution – There was a meaningful amount of M&A activity in the distribution of life insurance starting with the merger between LifeMark Partners and BRAMCO last year. Industry associations such as AALU and GAMA merged. Finally, large firms (public and private) such as Gallagher, Acrisure and Private Equity firms acquired large producer organizations and brokerage general agencies.

2021 looks bright but as I said before, it will not be for the faint of heart. AgencyONE will be covering many of these opportunities over the course of our 2021 Webinar series starting on January 21. Please be on the lookout for invitations and registration information.