This past Sunday while watching a morning news show, I was struck by a comment made by Larry H. Summers in an interview with Fareed Zakaria on the future of the economy post COVID-19. There were mentions of tax hikes. In the third minute of a 5-minute interview, when asked about our national debt, Mr. Summers said, and I quote:

“When we recover, we are going to have to have higher taxes in the United States like we did in the 1960’s and 1970’s and like most of the other countries in the world do. Fortunately, we can generate significant revenue, though maybe not enough, from the very rich, and certainly, that’s where any tax increase should start.”

Let’s Put Things in Perspective

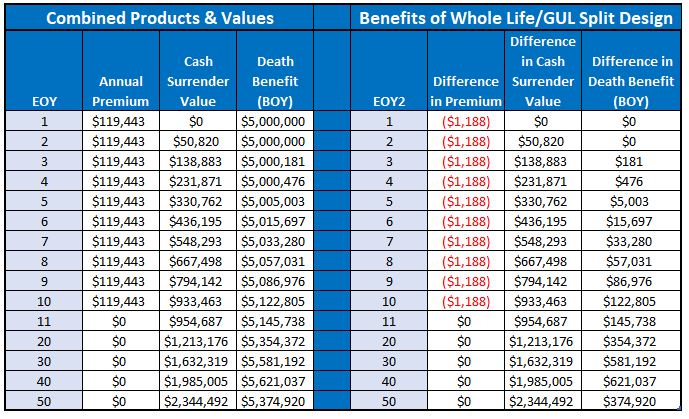

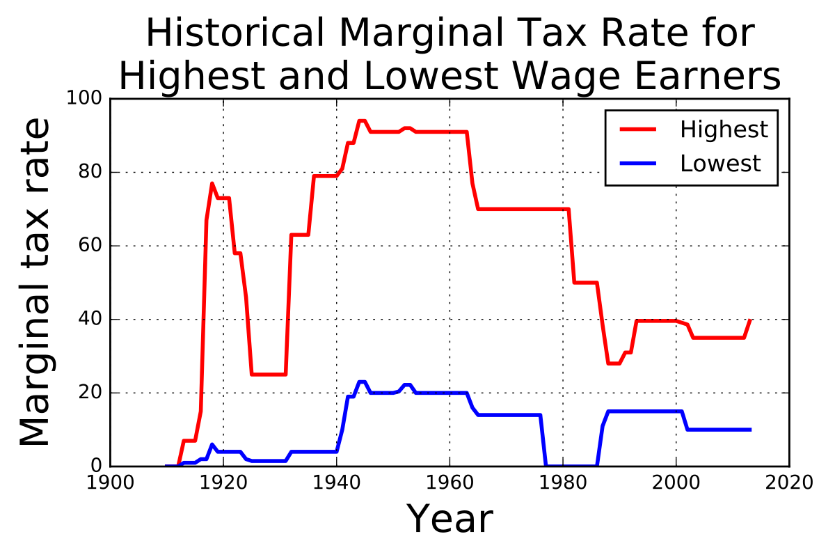

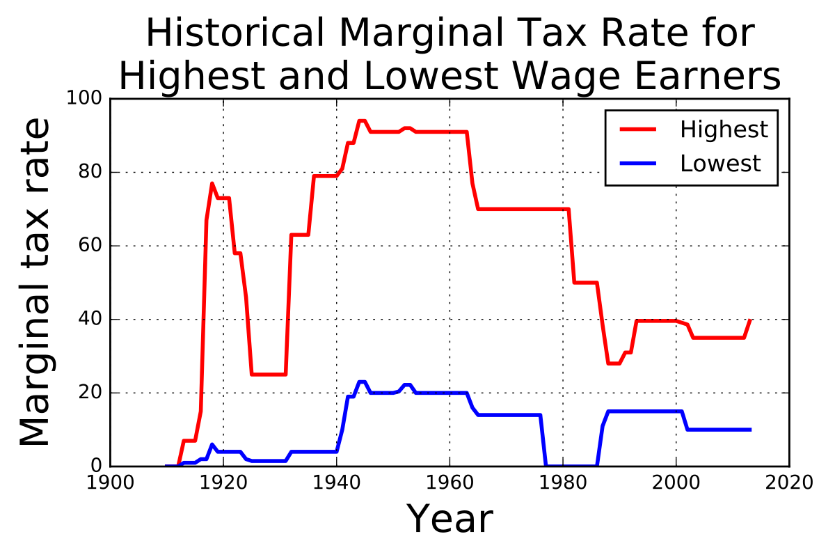

In 1960, the highest marginal tax rate was 91% for taxpayers that were married, filing a joint return, and  making over $400,000 annually. In 1965 that rate dropped to 70% for those couples making over $200,000 annually. It was not until 1982 that the rate dropped further to 50% for married taxpayers filing jointly and making over $85,600 per year with indexing in subsequent years. Only in 1987 did the marginal income tax rate drop to 38.5% on income over $90,000. Today, in 2020, the top marginal tax rate for those who are married and filing jointly is 37% for income over $622,050.

making over $400,000 annually. In 1965 that rate dropped to 70% for those couples making over $200,000 annually. It was not until 1982 that the rate dropped further to 50% for married taxpayers filing jointly and making over $85,600 per year with indexing in subsequent years. Only in 1987 did the marginal income tax rate drop to 38.5% on income over $90,000. Today, in 2020, the top marginal tax rate for those who are married and filing jointly is 37% for income over $622,050.

Now, Mr. Summers is no dummy. He is a former Treasury Secretary and one of America’s leading economists. In addition to serving as the 71st Secretary of the Treasury in the Clinton Administration, Mr. Summers served as Director of the White House National Economic Council in the Obama Administration, as President of Harvard University, and as the Chief Economist for the World Bank.

Will the United States experience a 70% or 91% marginal tax rate again post COVID-19? Who really knows, but I imagine that Mr. Summers knows a thing or two. What we can almost be assured of is this: Given the ballooning national debt, income tax rates WILL be higher than they are today, or the brackets will be arranged so that HIGHER INCOME EARNERS PAY A MUCH HIGHER OVERALL TAX as a percentage of their income. This brings me to the point of this article.

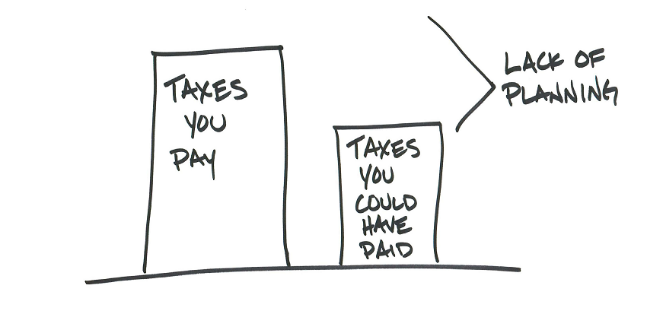

The Tax Trap

Most people have been indoctrinated to make pre-tax contributions to their 401K plans for years and in fact, the 401K plan has become THE retirement savings vehicle of choice for most Americans. There is a very good reason for this. If an employer offers a matching contribution, what employee would pass up a 25%, 50% or even 100% immediate return on their investment? Typically, most employers limit their match to 5% or 6% of contributions made by employees. In fact, the most common 401K plan design is a 50% match for up to a 6% deferral.

Most people have been indoctrinated to make pre-tax contributions to their 401K plans for years and in fact, the 401K plan has become THE retirement savings vehicle of choice for most Americans. There is a very good reason for this. If an employer offers a matching contribution, what employee would pass up a 25%, 50% or even 100% immediate return on their investment? Typically, most employers limit their match to 5% or 6% of contributions made by employees. In fact, the most common 401K plan design is a 50% match for up to a 6% deferral.

The downside of this kind of savings, given Mr. Summers predictions of future taxes, is that all distributions made during retirement are deemed taxable income and will likely be taxed at a higher rate than they currently are today. Furthermore, these taxable distributions impact how a taxpayer’s Social Security benefits are taxed as well. The American Association of Retired Persons (AARP) notes that:

The portion of your benefits subject to taxation varies with income level. You’ll be taxed on:

- up to 50 percent of your benefits if your income is $25,000 to $34,000 for an individual or $32,000 to $44,000 for a married couple filing jointly.

- up to 85 percent of your benefits if your income is more than $34,000 for an individual or $44,000 for a married couple filing jointly.

Say you file individually, have $50,000 in income, and get $1,500 a month from Social Security. You would pay taxes on 85 percent of your $18,000 in annual benefits from Social Security, or $15,300. Nobody pays taxes on more than 85 percent of their Social Security benefits, no matter their income

Many people now recognize this tax-trap and are exploring the benefits of Roth IRA’s or Roth 401K’s (if that  option is available through their employer). The problem with Roth IRA’s is that not everyone can take advantage of funding a Roth. Married taxpayers filing a joint return have a maximum contribution limit of $6,000 annually if their Modified Adjusted Gross Income (MAGI) is less than $196,000 and is phased out to ZERO if their MAGI is over $206,000. A Roth 401K has a limit of $19,500 annually if under age 50 with a catch up of an additional $6,500 for a total of $26,000 annually if age 50 or older. Both Roth IRA and Roth 401K distributions are income tax free AND are also not considered income for Social Security income threshold taxation purposes.

option is available through their employer). The problem with Roth IRA’s is that not everyone can take advantage of funding a Roth. Married taxpayers filing a joint return have a maximum contribution limit of $6,000 annually if their Modified Adjusted Gross Income (MAGI) is less than $196,000 and is phased out to ZERO if their MAGI is over $206,000. A Roth 401K has a limit of $19,500 annually if under age 50 with a catch up of an additional $6,500 for a total of $26,000 annually if age 50 or older. Both Roth IRA and Roth 401K distributions are income tax free AND are also not considered income for Social Security income threshold taxation purposes.

PROPERLY Designed Life Insurance

Another solution to this tax-trap is properly designed cash value life insurance. Yes, life insurance. Now, before I get hammered by most of the financial planning community, let’s be clear, the operative words are “properly designed”.

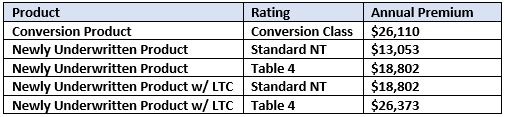

What do I mean by that? Most people traditionally think of life insurance in terms of paying the least amount of premium per dollar of death benefit. When I say, “properly designed”, I mean purchasing the lowest possible amount of death benefit allowable under the law for the desired contribution amount. Said a different way, a “properly designed” life policy would be one that pays the highest premium allowable for the lowest amount of death benefit. If your client needs additional insurance protection for other needs such as family protection, term insurance or an otherwise low-cost permanent solution should be considered.

What do I mean by that? Most people traditionally think of life insurance in terms of paying the least amount of premium per dollar of death benefit. When I say, “properly designed”, I mean purchasing the lowest possible amount of death benefit allowable under the law for the desired contribution amount. Said a different way, a “properly designed” life policy would be one that pays the highest premium allowable for the lowest amount of death benefit. If your client needs additional insurance protection for other needs such as family protection, term insurance or an otherwise low-cost permanent solution should be considered.

The idea of paying a higher premium seems counter intuitive. Who would want to do that? Perhaps someone looking to take advantage of the unique taxation opportunities that cash value insurance is afforded under the law. Internal Revenue Code section 7702 defines a maximum premium contribution allowed to ensure that cash value grows tax deferred and can be distributed tax free when needed. Why would the IRS impose a maximum contribution to cash value life insurance? Think about that for a moment.

Unlike a Roth, cash value life insurance has no income limits or phaseout rules. Other than those two attributes, they essentially look and feel the same. Both are paid with after-tax dollars; both grow tax deferred; both have tax-free distributions when needed; and both are not subject to age accelerations as a result of required minimum distributions at age 72. Both products also have a myriad of investment options from equity accounts to fixed interest accounts and everything in between. This is not an endorsement of any particular cash value product (whole life or any universal life products in their variety of flavors – current interest, index, or variable). Customer suitability information is required to make the right choice.

The biggest difference is that life insurance has expenses associated with it – the cost of insurance (COI). With that comes an income tax free death benefit for the named beneficiary(ies) should the individual die prior to completing the requisite funding period, in this case, retirement. As covered in AgencyONE’s October 25, 2019 ONEIdea, properly designed cash value life insurance is not as expensive, compared to other alternatives, as media pundits claim. In fact, the higher your tax rate the more beneficial cash value life insurance is.

New Proprietary Products

AgencyONE has recently gained distribution access to TWO LOW-COST proprietary Index Universal Life products that are IDEALLY SUITED FOR FUNDING TAX FREE RETIREMENT NEEDS. We hosted multiple webinars specifically focused on these IUL products and recordings of the webinars can be found on your AgencyONE 100 Advisor Dashboard on our website. Furthermore, on Monday, June 8th, we will be hosting a webinar with author of the “Power of Zero”, David McKnight, who will highlight the significant tax benefits of life insurance. You will receive an invitation for this webinar with further details the first of next week.

AgencyONE stands ready to discuss insurance options with you and your clients who are looking for a Roth-like alternative for creating tax free income streams in, what is likely to be, a higher income tax environment when they retire.