Does Lowest Premium Mean Best Value?

When advising clients about legacy and estate planning, many financial, legal, and accounting advisors recommend insurance solutions, generally owned by irrevocable life insurance trusts (ILITs), to provide the needed liquidity to complete stated wealth transfer and legacy objectives. WHY?

- Life insurance provides an income and estate/ inheritance tax-free cash payment when owned by an ILIT.

- Life insurance enjoys an automatic step up in basis, and hence no capital gains taxes are paid on any gain over the amount paid (basis), when owned in a trust. This cannot be said about other capital assets that may have to be sold at a taxable gain to provide cash payments from a trust to beneficiaries.

- Life insurance is completely uncorrelated to all other capital markets and pays a lump sum cash benefit exactly when it is needed for exactly the expected amount.

- Life insurance benefits can be guaranteed for life.

Life Insurance Benefits and Guaranteed Returns

Life Insurance Benefits and Guaranteed Returns

Long-dated guarantees and low premiums are important to many, if not most, permanent life insurance designs. However, if the advisor is simply recommending a solution based on the lowest premium available, he or she may be missing additional value for the beneficiaries to whom the trustee owes a fiduciary duty.

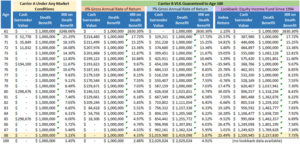

Consider a 60-year-old male client, a best-class risk, who is applying for $1MM of coverage. He would like a policy that is paid-up after 10 years and fully guaranteed to age 100. The advisor obtains various quotes from insurance companies and finds that Carrier A will provide the guaranteed coverage desired for the lowest premium at $29,868 annually for 10 years. The same $1MM of guaranteed coverage at Carrier B costs $36,626 annually for 10 years for the same guarantees to age 100. Easy decision, right? Not so fast!

Carrier A’s product is the type of Guaranteed Universal Life (GUL) contract that you may be familiar with – it essentially behaves like a level premium term contract to age 100. Carrier B’s product is a protection oriented Variable Universal Life (VUL) solution that provides the same guaranteed coverage to age 100 BUT offers far more flexibility and upside than the GUL solution.

Lower Premium or More Upside

Would your client rather have the lower premium option with no market participation or upside potential, OR a contract that has the potential to accumulate significant cash values, provide future opportunities for 1035 exchanges (to other solutions should needs change), a cash payment exit strategy or higher death benefits if the cash value growth causes a death benefit increase? Let’s look at some numbers to compare:

provide future opportunities for 1035 exchanges (to other solutions should needs change), a cash payment exit strategy or higher death benefits if the cash value growth causes a death benefit increase? Let’s look at some numbers to compare:

- Carrier A – $29,868 guaranteed level 10-pay premium

- Carrier B – $36,626 guaranteed level 10-pay premium

Carrier A certainly wins on premium and hence a higher rate of return at death. HOWEVER, the cash value, death benefit, and IRR on death benefit make a compelling case for Carrier B. The table below shows how each policy would perform under a few different market conditions – a 0% annual return, a 7% annual return, and tracking the performance of an equity fund with historical performance data (See the full comparison linked HERE).

As previously stated, Carrier A requires a guaranteed premium for 10 years with a guaranteed death benefit to age 100, while Carrier B requires a higher guaranteed premium for the same 10 years.

Illustration Rates Are Sequential

The problem with life insurance quotes, and much of the analysis used to make recommendations, is that illustration rates are sequential. In a GUL, it is an irrelevant fact because the interest rate assumption does not impact the performance of the contract. IT IS GUARANTEED – the owner pays a stated premium as due for 10 years and the insurance company pays the death benefit – period, end of story. BUT in a VUL, sub-account/ investment performance is not sequential, even though it is illustrated as such, for example the 7% sequential return as seen above. Combining the two, however, a contractual guarantee for a death benefit with a market-based upside potential, is the best of both worlds!

Historical Lookback Analysis

Many advisors are not aware that a historical lookback is available for this analysis, as seen in the chart above. The Equity Income Fund returns seen in the fourth column from the right of the analysis is the actual performance of that sub-account. It is the combination of a guaranteed death benefit WITH this potential upside which needs to be considered in any insurance solution.

right of the analysis is the actual performance of that sub-account. It is the combination of a guaranteed death benefit WITH this potential upside which needs to be considered in any insurance solution.

While Carrier A’s guaranteed premium refund option provides meaningful surrender values in select years, Carrier B provides meaningful cash values even at a 0% annual return. Looking at a 7% projection or the historical lookback, it’s not even close! At age 88, a reasonable life expectancy for a healthy 60-year-old, the historic lookback projects a $2.15MM death benefit – more than twice the death benefit, and an IRR which is two and a half percentage points higher than the GUL!

Maximize Upside Minimize Risk

In legacy and estate planning, the key metric for the success of any fiduciary is to maximize the upside potential for the beneficiaries of an asset, while minimizing risk. Had this client bought this asset 28 years ago, and assuming death at age 88, they would have had a guarantee of a 4.33% tax free return with actual performance of 7.73% – Tax Free.

In legacy and estate planning, the key metric for the success of any fiduciary is to maximize the upside potential for the beneficiaries of an asset, while minimizing risk. Had this client bought this asset 28 years ago, and assuming death at age 88, they would have had a guarantee of a 4.33% tax free return with actual performance of 7.73% – Tax Free.

As a final comment, because Carrier B’s contract is fully guaranteed to age 100, the client and his or her investment advisor are free to choose aggressive growth-focused allocations to capture as much market upside as possible, leading to potential future death benefit increases.

AgencyONE’s Case Designers are experts in the analysis required to ensure that your clients risk planning needs align with their financial goals.

Please contact the AgencyONE Marketing Department at 301.803.7500 for more information or to discuss a case.

*For Advisor Use Only