The Problem, The Truth + The Solution Behind Accelerated Underwriting Programs

The Problem

So, what is “The Problem”? The problem is that many of these AUPs are woefully lacking in what the carriers call “throughput” – which are applications submitted that are successfully accelerated without exams. Clients are being rejected from these programs after the application has been submitted and this presents an issue for BOTH the client, the advisor and for AgencyONE. But not everyone is rejected, and this is where “the truth” is important.

The Truth

The Solution

|

“The Solution” is using the tools and questionnaires available to do comprehensive field underwriting prior to carrier selection and case submission to do everything possible to ensure that your case experiences AUP throughput. Statistics confirm that with good field underwriting, throughput does significantly increase! One carrier reports that their approval rate increased from 41% (no pre-screening/checklist) to 60% with the advisor using the checklist (average age – 39) and there are other carriers whose statistics also confirm this conclusion.

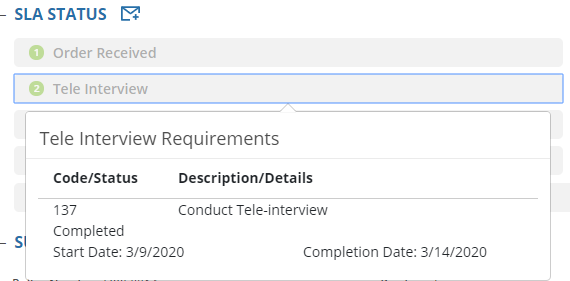

Last week AgencyONE had a webinar on our VIVE submission platform. This platform has a Health Analyzer questionnaire that will tell you if your client will likely qualify for AUP. It can be quickly completed by asking the client a few additional questions – consider this “field underwriting” (yes, back to the basics of Insurance 101).

Other platforms which we have highlighted, such as iGO, also have similar screening questionnaires. In addition, many of the carriers that offer AUPs have checklists that can be completed to provide guidance on whether the prospective insured is a good candidate for accelerated underwriting.

If you (the advisor) use the screening checklist, the chances of success are far greater than if you don’t. And the advisors that discuss the details of their case IN ADVANCE with the AgencyONE Underwriting Team and seek advice on carrier selection are also experiencing a greater percentage of throughput success. Additionally, full disclosure with the client is critical. It is imperative that you discuss with your client, UPFRONT, that even with fabulous field underwriting there is a possibility that the case MAY NOT qualify for AUP (some people will walk through the TSA checkpoint at the airport and will get pulled out of line for a random “pat down” for no obvious reason).

|